Tag: AI in Insurance

Californian firms dominated the US InsurTech industry with a third of...

Key US InsurTech investment stats in Q4 2025:

US InsurTech deal activity grew by 33% YoY in Q4 2025

Californian firms secured a third...

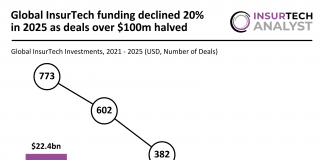

Global InsurTech funding declined 20% in 2025 as deals over $100m...

Key global InsurTech investment stats in 2025:

Global InsurTech investments declined by 20% YoY in 2025

Deals over $100m halved as investors shifted toward...

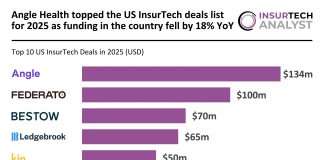

Angle Health topped the US InsurTech deals list for 2025 as...

Key US InsurTech investment stats in 2025:

US InsurTech funding fell by 18% YoY in 2025

New York, California, Texas and Illinois were tied...

UK firms secured over a third of all European InsurTech deals...

Key European InsurTech investment stats in 2025:

European InsurTech deal activity fell by 12% YoY in 2025

UK firms dominated the European InsurTech marketplace...

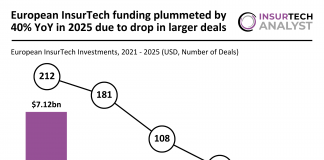

European InsurTech funding plummeted by 40% YoY in 2025 due to...

Key European InsurTech investment stats in 2025:

European InsurTech funding plummeted by 40% YoY

Larger deals (over $100m) dropped by 44% as investors grew...

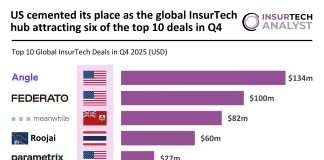

US cemented its place as the global InsurTech hub attracting six...

Key global InsurTech investment stats in Q4 2025:

Global InsurTech funding doubled YoY in Q4

US companies secured six of the top 10 deals...

Sapiens reshapes leadership after Advent acquisition

Sapiens International Corporation N.V. has unveiled a sweeping set of senior leadership changes as it enters a new chapter as a privately held company...

Cytora embeds open-source intelligence to reduce claims leakage

Cytora has entered a new partnership with Pilotbird as it looks to strengthen fraud detection and claims accuracy for commercial and property and casualty insurers.

Through...

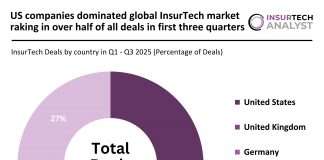

US companies dominated global InsurTech market raking in over half of...

Key global InsurTech investment stats in Q1 - Q3 2025:

Global InsurTech deal activity dropped by 12% YoY

US companies secured over half of...

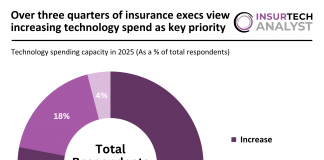

Over three quarters of insurance execs view increasing technology spend as...

Insurance investment stats in 2025:

120 insurance leaders across carriers, agencies and tech firms were surveyed on 2025 priorities

78% of respondents expected to...