Tag: Data

The role of ESG data in modern insurance underwriting

Insurance firms have begun implementing environmental, social and governance (ESG) data into their offerings amidst a swell of pressure from stakeholders. This data is transforming underwriting profitability, enabling better risk assessments, product innovation, and regulatory compliance.

How Symfa can help you transform raw data into valuable insights

In today’s data-driven world, the ability to turn raw data into actionable insights is more crucial than ever. With vast amounts of information being generated daily, businesses must navigate the complexities of data cleaning, processing, and standardisation to uncover trends, patterns, and opportunities. This is where Symfa, an innovative software development company, excels — helping businesses turn fragmented and inconsistent data into reliable, insightful, and valuable information.

How Earnix is tackling model bias in insurance data

Insurance data, in an ideal world, would perfectly reflect reality. However, data is often inherently biased, whether due to uneven sampling or systemic selection...

CeresAI secures Series D funding to drive AI-powered growth

CeresAI, a data and analytics provider, has completed a Series D funding round led by Remus Capital, as it looks to help lenders and insurers reduce farming risks through advanced technology.

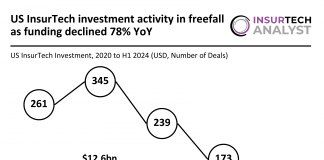

US InsurTech investment activity in freefall as funding declined 78% YoY

Key US InsurTech investment stats in H1 2024:

US InsurTech market in a slump as funding dropped by 78% YoY

Healthee secured the biggest...

How dacadoo can help you navigate health and lifestyle data challenges

Handling health and lifestyle data involves several intricate challenges, primarily due to the sensitive nature of the information. Ensuring privacy is a top priority, and securing consent for data use can be complex, especially if not addressed early in the process. This often restricts analysis to internal use only, limiting the involvement of external experts and increasing the risk of bias due to broad consent requirements.

Applied Systems launches all-new data analytics capability for US and Canadian...

Applied Systems®, a leading provider of cloud-based software that powers the business of insurance, has announced the general release of an all-new data analytics capability.

IFoA and CISI join forces to boost ethical AI understanding for...

The Institute and Faculty of Actuaries (IFoA), and the Chartered Institute for Securities & Investment (CISI) have formed a partnership aimed at supporting actuaries in enhancing their understanding of ethical issues when deploying artificial intelligence (AI).

Scanbot SDK launches Web Data Capture Demo

In today’s tech landscape, innovations in software development kits (SDKs) continue to redefine how businesses handle data processing and automation. Following the success of its Barcode and Document Scanner SDKs, Scanbot SDK has introduced its latest offering: the Web Data Capture Demo.

Aspen Insurance launches new platform to revolutionise AI and data strategy

Aspen Insurance Holdings Limited, a prominent global insurance and reinsurance company, has launched a new platform designed to advance its digital strategy and drive its data and artificial intelligence agenda forward.