Tag: Data analytics

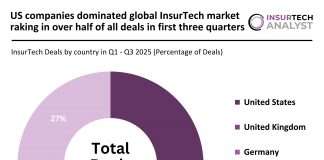

US companies dominated global InsurTech market raking in over half of...

Key global InsurTech investment stats in Q1 - Q3 2025:

Global InsurTech deal activity dropped by 12% YoY

US companies secured over half of...

Climate X integrates Fathom flood model for global insight

Climate X, a global leader in climate risk intelligence and resilience analytics, has partnered with Fathom, a pioneer in flood risk modelling, to deliver...

London based Quantexa tops the list of largest UK InsurTech deals...

Key European InsurTech investment stats in Q1 2025:

European InsurTech funding decreased by 7% YoY in Q1 2025

UK dominated the European InsurTech deal...

Xceedance bolsters inspection capabilities with Millennium Information Services acquisition

Xceedance, a global leader in insurance-focused consulting, technology, operations support, and data solutions, has acquired Millennium Information Services, a major player in property inspection and data analytics in the US.

Juniper pioneers in reproductive health with innovative insurance coverage

Juniper has identified a significant gap in the health insurance market by offering comprehensive reproductive insurance, a critical area often overlooked by conventional health plans.

Verisk launches Claims Advisory Board to drive insurance innovation

Verisk, a prominent global data analytics and technology provider, has established an Advisory Board to meet the ever-evolving needs of claims organisations in the insurance industry.

InsurTech Kalepa adds Japanese industry leader to Advisory Board

New York-based InsurTech Kalepa has revealed the appointment of a Japanese industry leader to its Advisory Board.

Pricing teams in a changing world: evolving backgrounds and expectations

In recent times, there has been a rapid evolution of the actuarial field amidst surging data volumes and technological advancements. Actuaries now grapple with...

Greater Than’s data analytics enables ABAX to launch connected fleet insurance...

Greater Than has revealed that its highly-vaunted artificial intelligence (AI) software has enabled ABAX to launch a new and autonomous car insurance broker brand.

Data analytics – the next frontier for insurance

The digital transformation of the insurance industry has been underway for many years. Carriers have drastically improved their efficiency, speed and accuracy through the implementation of new technologies. Now the sector may be looking towards data analytics to make the latest leap in the space.