Tag: Data

CeresAI secures Series D funding to drive AI-powered growth

CeresAI, a data and analytics provider, has completed a Series D funding round led by Remus Capital, as it looks to help lenders and insurers reduce farming risks through advanced technology.

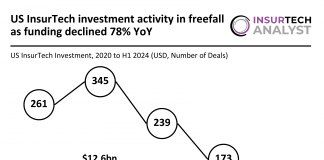

US InsurTech investment activity in freefall as funding declined 78% YoY

Key US InsurTech investment stats in H1 2024:

US InsurTech market in a slump as funding dropped by 78% YoY

Healthee secured the biggest...

How dacadoo can help you navigate health and lifestyle data challenges

Handling health and lifestyle data involves several intricate challenges, primarily due to the sensitive nature of the information. Ensuring privacy is a top priority, and securing consent for data use can be complex, especially if not addressed early in the process. This often restricts analysis to internal use only, limiting the involvement of external experts and increasing the risk of bias due to broad consent requirements.

Applied Systems launches all-new data analytics capability for US and Canadian...

Applied Systems®, a leading provider of cloud-based software that powers the business of insurance, has announced the general release of an all-new data analytics capability.

IFoA and CISI join forces to boost ethical AI understanding for...

The Institute and Faculty of Actuaries (IFoA), and the Chartered Institute for Securities & Investment (CISI) have formed a partnership aimed at supporting actuaries in enhancing their understanding of ethical issues when deploying artificial intelligence (AI).

Scanbot SDK launches Web Data Capture Demo

In today’s tech landscape, innovations in software development kits (SDKs) continue to redefine how businesses handle data processing and automation. Following the success of its Barcode and Document Scanner SDKs, Scanbot SDK has introduced its latest offering: the Web Data Capture Demo.

Aspen Insurance launches new platform to revolutionise AI and data strategy

Aspen Insurance Holdings Limited, a prominent global insurance and reinsurance company, has launched a new platform designed to advance its digital strategy and drive its data and artificial intelligence agenda forward.

What impact could data have on InsurTech?

In a field built upon numbers, data can be considered the cornerstone of success. In the InsurTech realm, this feeling is no different. But as modernisation and digitisation becomes ever more paramount in the business world, the transformative potential that harnessing accurate data has advanced tenfold.

Are insurers thinking about the value proposition for consumers by collecting...

In the ever-evolving landscape of insurance, the quest to better serve consumers is a constant battle. In an attempt to craft the ultimate value proposition for consumers, incumbents are harnessing the power of real-time data to revolutionise the way in which they operate.

What is the role of price optimisation in insurance?

Actuaries, often dubbed as mathematical risk managers, play a pivotal role in the insurance industry. Their expertise in quantifying and managing risk is essential for insurers in a market where financial responsibility for potential negative outcomes is traded. However, determining the cost of this responsibility isn't a straightforward task; it involves estimating expected losses akin to manufacturing costs for tangible goods. Yet, setting a price demands more than just knowing costs; it requires calibrating profit margins to market realities and consumer behaviours. InsurTech Quantee delves into the intricate process, known as price optimisation.