Tag: Digital transformation

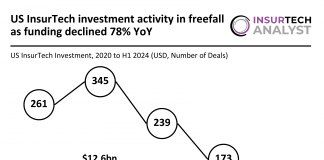

US InsurTech investment activity in freefall as funding declined 78% YoY

Key US InsurTech investment stats in H1 2024:

US InsurTech market in a slump as funding dropped by 78% YoY

Healthee secured the biggest...

Ushur and mortgage giant team up: A leap towards eco-friendly paperless...

One of America's largest mortgage servicers has been facing a significant challenge. The company, which was established in the early 1990s and operates across...

Madanes partners with Novidea for a groundbreaking digital overhaul in insurance...

Madanes Insurance Agency, a leading insurance broker specializing in complex insurance schemes across property, liability, and health sectors, along with risk and claims management, has partnered with Novidea.

How insurers can optimize claims and retain customers

Claims represent a pivotal moment in insurance, often determining customer loyalty and future business opportunities. They not only involve the insurer and the customer...

OpenRoad Insurance partners with Majesco to revolutionise collector vehicle insurance

OpenRoad Insurance, an emerging collector vehicle insurer, has teamed up with Majesco, a renowned provider of cloud insurance platform software.

Majesco announced that OpenRoad Insurance...

UK-based PeppercornAI bags £3.25m for AI-driven insurance solutions

PeppercornAI, an InsurTech specialising in conversational artificial intelligence, has successfully raised £3.25m.

Novidea secures $30m boost from HarbourVest to revolutionise InsurTech

Novidea has recently announced a significant development in its growth trajectory, securing an additional $30m in funding from HarbourVest Partners.

The future of healthcare: How insurers are using technology to cut...

Healthcare costs continue to be a major concern across the globe, with a slight dip projected in 2024, offering a glimmer of hope. dacadoo, a digital health technology platform that puts the customer engagement at the centre of business, recently explored how digital health technology can help insurers become 'affordability champions.'

PeppercornAI partners with ICE InsureTech to revolutionise insurance with AI

PeppercornAI, an emerging InsurTech firm, announced its inaugural strategic partnership with ICE InsureTech, a provider known for delivering innovative insurance technology solutions.

One Inc secures strategic investment from Nordic Capital to spearhead digital...

One Inc, a pioneering digital payments platform dedicated to revolutionising the North American insurance industry, has recently announced a significant new investment from Nordic Capital.