Tag: Fintech

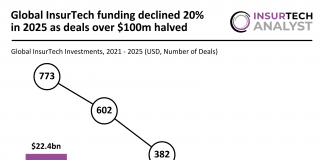

Global InsurTech funding declined 20% in 2025 as deals over $100m...

Key global InsurTech investment stats in 2025:

Global InsurTech investments declined by 20% YoY in 2025

Deals over $100m halved as investors shifted toward...

UK firms secured over a third of all European InsurTech deals...

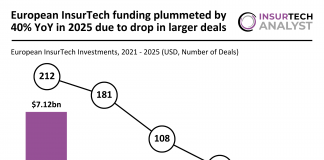

Key European InsurTech investment stats in 2025:

European InsurTech deal activity fell by 12% YoY in 2025

UK firms dominated the European InsurTech marketplace...

California retained its top position in the US InsurTech market with...

Key US InsurTech investment stats in 2025:

US InsurTech deal activity increased by 6% YoY

Californian companies retained their top spot in the US...

European InsurTech funding plummeted by 40% YoY in 2025 due to...

Key European InsurTech investment stats in 2025:

European InsurTech funding plummeted by 40% YoY

Larger deals (over $100m) dropped by 44% as investors grew...

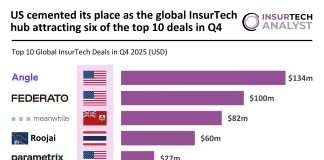

US cemented its place as the global InsurTech hub attracting six...

Key global InsurTech investment stats in Q4 2025:

Global InsurTech funding doubled YoY in Q4

US companies secured six of the top 10 deals...

Benekiva partners with Juice Financial to modernise claim payouts

Benekiva, a people-first claims automation platform, has announced a new partnership with Juice Financial, a FinTech specialising in fast, flexible and fully digital payment...

Socure uncovers identity fraud targeting Texas flood relief

Socure, an identity verification and risk decisioning company, has released new research detailing how disaster relief efforts following the July 2025 floods in Central...

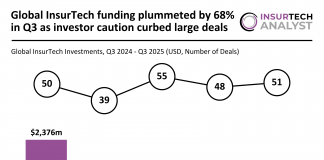

Global InsurTech funding plummeted by 68% in Q3 as investor caution...

Key Global InsurTech investment stats in Q3 2025:

Global InsurTech funding plummeted by 68% YoY in Q3

Investor caution curbed large deals with a...

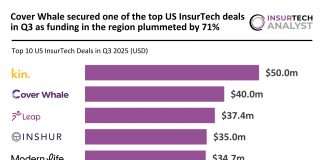

Cover Whale secured a top US InsurTech deal in Q3 as...

Key US InsurTech investment stats in Q3 2025:

US InsurTech funding plummeted by 71% YoY in Q3

New York emerged as the main hub...

Healthcare FinTech Cylerity raises $4m to speed payments

Madison-based Cylerity, a healthcare FinTech company that uses AI to accelerate payments to providers, has raised $4m in an oversubscribed seed round and secured...