Tag: hx Renew

UK continues to lead European InsurTech with a third of all...

Key European InsurTech investment stats in 2024:

European InsurTech deal activity dropped by 54% YoY

UK companies secured a third of the deals as...

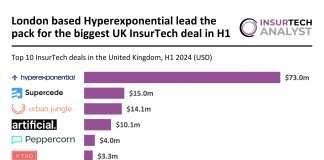

London based Hyperexponential lead the pack for the biggest UK InsurTech...

Key UK InsurTech investment stats in H1 2024:

UK InsurTech deal activity dropped by 32% in H1 2024 YoY

The average deal size completed...

AI’s role in revolutionising the insurance industry

At the inaugural hx Live conference, hyperexponential’s co-founder and CEO, Amrit Santhirasenan, delved into the company’s innovative approach to artificial intelligence (AI), and opened up on AI’s role in revolutionising the insurance industry.

5 key benefits of hx Renew for IT

Innovations in pricing decision intelligence are reshaping the landscape of the insurance industry, with hx Renew emerging as a pioneering platform at the forefront of this transformation. As the world’s first of its kind, hx Renew not only unlocks substantial value and industry-leading performance across the pricing process but also offers seamless implementation within existing systems, ensuring flexibility, scalability, and security.

Unlocking insurer success: The power of data integration with hx Renew

In the evolving landscape of insurance, the adage "knowledge is power" has never been more pertinent. This is especially true in an era where data acts as the lifeblood of decision-making processes.

5 ways hx Renew can be a game-changer for MGAs

In the dynamic landscape of insurance technology, hx Renew has emerged as a transformative force, empowering the world’s leading insurers of complex risks to revolutionise their pricing and underwriting strategies. hyperexponential delves into the five key advantages that make hx Renew a game-changer for modern Managing General Agents (MGAs).

Python in insurance: Paving the way for actuaries and insurers

The insurance sector, traditionally slow in embracing modernisation, is progressively adopting programming languages to refine workflows and bolster decision-making capabilities. Among these, Python has...

Enhancing insurance accuracy and efficiency with hx Renew technology

In the rapidly evolving landscape of InsurTech, a new game-changer has emerged: hx Renew. This cutting-edge platform is redefining how actuarial teams operate, offering...

The future of reinsurance: Technology and skills gap in focus

The state of reinsurance pricing in 2023 is under scrutiny. With the landscape of risks evolving at an unprecedented pace, reinsurers are facing significant barriers to optimally underwriting risks. A staggering 70% of underwriters acknowledge that this rapidly changing environment presents the greatest challenge to their ability to underwrite risks effectively.

Conduit Re Adopts hyperexponential’s PDI Platform

Conduit Re, based in Bermuda, and hyperexponential, a leading pricing decision intelligence (PDI) firm, have embarked on a transformative partnership.