Tag: insurtech

The current state of insurance onboarding: Key trends and insights

As UK insurers grapple with rising claims costs and escalating premiums, the pressure on onboarding processes has never been greater. Motor claims payouts surged by 18% last year, while British drivers faced premium hikes of over a third, outpacing the rest of Europe. At the same time, home insurance renewal quotes soared by 42%, leaving insurers scrambling to adapt. Given these tribulations, the efficiency and effectiveness of insurance onboarding has become crucial.

Novidea expands in the London Market with new headquarters to drive...

Novidea, a leading InsurTech firm known for its cloud-based, data-driven insurance enterprise management platform, has bolstered its presence in the London Market by relocating to a larger office space in the heart of the City of London.

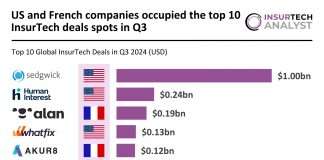

US and French companies occupied the top 10 InsurTech deals spots...

Key Global InsurTech investment stats in Q3 2024:

Global InsurTech deal activity dropped by 49% YoY

US and French companies completed all of the...

Qover and Mastercard partner to enhance online shopping protection in Belgium...

Qover, a leading InsurTech company specialising in embedded insurance solutions, has partnered with Mastercard to improve the online shopping experience for Mastercard credit cardholders in Belgium and Luxembourg.

How Symfa helped a Fortune 500 insurer modernise its cloud infrastructure...

Migrating from on-premises to cloud infrastructure is a major leap for any organisation. This was the case for a Fortune 500 insurer seeking to modernise its operations. Their existing system, which relied on outdated methods and manual processes, was no longer fit to handle the enormous amounts of data generated daily. This transformation involved building a robust, automated platform, transitioning to the cloud, and optimising for efficiency and scalability. Customer software development company Symfa explains how it supported the firm on this journey.

Qualys partners with Mulberri to transform cyber insurance underwriting

Mulberri, a digital insurance platform focused on innovating business insurance, has joined forces with Qualys in a bid to deliver enhanced cyber insurance offerings.

Duck Creek Technologies expands with new centre of excellence in Poland

Duck Creek Technologies, a global provider of intelligent solutions for property and casualty (P&C) and general insurance, has announced the opening of a second Centre of Excellence (CoE) in Warsaw, Poland.

How to integrate comprehensive services into insurance apps

Incorporating essential services into insurance apps is crucial for boosting customer engagement and enhancing the overall user experience. Hosting a recent webinar, Manal Hoyer, Chief Operating Officer at dacadoo, sat down with Marleydy Arias Sarmiento, Digital Experience and Marketing Transformation Manager at Seguros Bolivar, to discuss how insurers can integrate comprehensive services into insurance apps to create seamless, value-added experiences.

Insurity partners with ICEYE to deliver real-time catastrophe insights to P&C...

Insurity has partnered with ICEYE to integrate real-time catastrophe insights into its platform, enhancing P&C insurers’ ability to respond faster and more effectively to disasters.

Oyster launches new AI-powered products to transform P&C insurance for SMBs

Oyster has released an innovative suite of digital products aimed at revolutionising the property and casualty (P&C) insurance experience for small and medium-sized businesses (SMBs).