Tag: UK

Unitary expands UK broker automation through BIBA partnership

Unitary, an automation platform helping businesses reduce manual repetitive work without costly, multi-year overhauls, has joined the British Insurance Brokers’ Association (BIBA) as an...

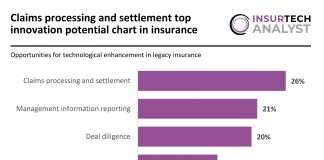

Claims processing and settlement top innovation potential chart in insurance

Key trends in legacy insurance market:

Solvency II, Brexit, and Lloyd’s Decile 10 review were key players in the rapid transformation of the insurance...

Coalition boosts cyber-defence arsenal with new hire

Coalition, a global cybersecurity firm, has bolstered its cyber-defence arsenal with the appointment of a new incident response lead for the UK.

Former acting Sergeant...

European InsurTech deals suffer decline but UK still leads the way

The European InsurTech deals sector suffered a sharp downturn in fortune in 2023, but the United Kingdom (UK) remained the pre-eminent force on the continent.

ARMD and Sparta Insurance join forces to revolutionise UK tradespeople’s tool...

ARMD, an InsurTech leading the way in serving the UK's tradespeople market, has teamed up with Sparta Insurance Services, a prominent wholesale broker distribution platform, specialises in connecting insurance products with brokers across the UK.

UK Insurtech CatX secures $2.7m to bridge reinsurance gap

UK InsurTech startup CatX has successfully raised $2.7m in seed funding as the company looks to bridge the gap between supply and demand in the reinsurance sector.

Why CDR matters for London market brokers

The London Market is on the precipice of a digital transformation, and one significant initiative propelling this change is the Core Data Record (CDR). This strategic move aims to standardise and streamline the collection of critical transaction data, marking a pivotal leap in market efficiency. InsurTech Novidea explains why CDR matters for London market brokers.

Novidea bolsters sales team to meet increasing demand for insurance management...

Novidea, a prominent InsurTech company, has bolstered its sales team to meet the increasing demand for its renowned insurance management platform in the UK.

MarshBerry acquires IMAS Corporate Finance

MarshBerry, a global M&A advisory firm for insurance brokers, has revealed that it has acquired IMAS Corporate Finance LLP (IMAS).

How Ascent is helping insurers and reinsurers boost profitability

Founded in 2005, Ascent has a key mission: help insurers and reinsurers become

more profitable by accelerating their ability to transact. We recently spoke to CCO

George Earp and Principal Architect Konrad Pfeffer to find out more.