Tag: underwriting automation

Why underwriting workbenches are transforming insurance

For decades, the underwriting process has been slowed by labour-intensive tasks, disjointed systems, and repetitive manual work.

Traditional methods often require underwriters to gather information...

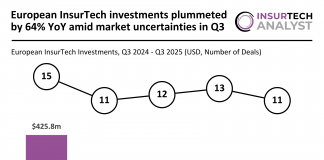

European InsurTech investments plummeted by 64% YoY amid market uncertainties in...

Key European InsurTech investment stats in Q3 2025:

European InsurTech investments plummeted by 64% YoY in Q3

Average deal value halved to $13.9m as...

AI neo-insurer MGT secures $21.6m Series B funding

AI-driven commercial insurer MGT, a vertically AI-native neo-insurer focused on modernising property and casualty (P&C) coverage for small businesses, has closed an oversubscribed $21.6m...

US companies dominated the global InsurTech market with six of the...

Key Global InsurTech investment stats in H1 2025:

Global InsurTech funding increased by 9% in H1 YoY

US companies secured six of the top...

AI-driven Magic Placement transforms underwriting with smarter document insights

Insurance brokers are under growing pressure to process increasingly complex documentation while maintaining accuracy and speed. From comparing quotes to evaluating binders and policies,...

AI in insurance underwriting: Overcoming challenges and unlocking value

Artificial intelligence (AI) is having a profound impact on insurance underwriting, transforming long-established processes and significantly improving insurers’ capabilities. From improving risk assessment to tailoring offers and automating administrative functions, AI is enabling a new era of agility and competitiveness in the InsurTech space, as Earnix explains.

US firms secured half of all InsurTech deals in Q1 2025...

Key Global InsurTech investment stats in Q1 2025:

Global InsurTech funding increased by 59% YoY

US firms secured half of all InsurTech deals in...

Cytora joins Google Cloud Marketplace to expand AI risk digitisation for...

Cytora, an AI-powered risk digitisation platform, has announced its availability on Google Cloud Marketplace, as it looks to enhance accessibility for insurers, managing general...

AI-driven risk assessment propels the AI in insurance market to $141bn...

AI in insurance market is expected to grow from $8.13bn in 2024 to $141.44bn by 2034, driven by investments in AI-powered risk assessment...

Cytora and Xapien unite to revolutionise due diligence in commercial insurance

Cytora, a leading digital risk processing platform, has formed a strategic partnership with Xapien, an innovative company known for its AI-powered due diligence capabilities.