Tag: underwriting technology

Californian firms dominated the US InsurTech industry with a third of...

Key US InsurTech investment stats in Q4 2025:

US InsurTech deal activity grew by 33% YoY in Q4 2025

Californian firms secured a third...

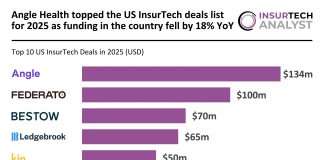

Angle Health topped the US InsurTech deals list for 2025 as...

Key US InsurTech investment stats in 2025:

US InsurTech funding fell by 18% YoY in 2025

New York, California, Texas and Illinois were tied...

California retained its top position in the US InsurTech market with...

Key US InsurTech investment stats in 2025:

US InsurTech deal activity increased by 6% YoY

Californian companies retained their top spot in the US...

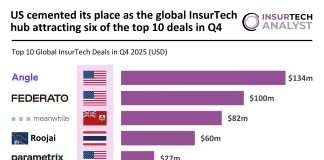

US cemented its place as the global InsurTech hub attracting six...

Key global InsurTech investment stats in Q4 2025:

Global InsurTech funding doubled YoY in Q4

US companies secured six of the top 10 deals...

TruStage partners with ZestyAI on AI-driven property risk analytics

TruStage, a financially strong insurance and financial services provider serving middle-market consumers and businesses, has partnered with ZestyAI, a Risk and Decision Intelligence Platform...

California firms dominated US InsurTech market from Q1 – Q3 as...

Key US InsurTech investment stats in Q1 – Q3 2025:

US InsurTech deal activity held steady at 110 transactions in Q1-Q3

California continued to...

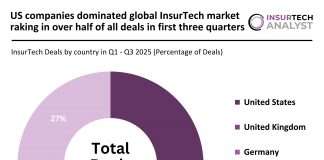

US companies dominated global InsurTech market raking in over half of...

Key global InsurTech investment stats in Q1 - Q3 2025:

Global InsurTech deal activity dropped by 12% YoY

US companies secured over half of...

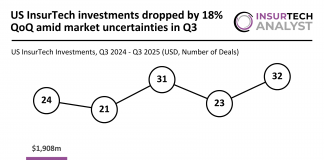

US InsurTech investments dropped by 18% QoQ amid market uncertainties in...

Key US InsurTech investment stats in Q3 2025:

US InsurTech investments dropped by 18% QoQ in Q3

Average deal value fell to $17.5m as...

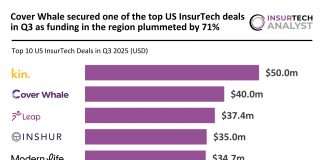

Cover Whale secured a top US InsurTech deal in Q3 as...

Key US InsurTech investment stats in Q3 2025:

US InsurTech funding plummeted by 71% YoY in Q3

New York emerged as the main hub...

Californian companies dominated the US InsurTech market with 26% of all...

Key US InsurTech investment stats in Q2 2025:

US InsurTech deal activity grew by 31% YoY in Q2

Californian companies secured 26% of US...