Home and auto insurance platform Goji has closed a $15m equity round led by Hudson Structured Capital Management.

Boston-headquartered Goji is an independent online loans agency that combines human processes with smart technology to find the best coverage for a consumer. The platform uses machine learning technology to create quotes based on customer attributes, interactions, quotes and policies.

Originally founded in 2007 as Consumers United, the company rebranded as Goji in 2014. Currently, the agency is fully-licensed in 41 US states.

Goji CEO Peter Breitstone said, “Goji has a leading-edge platform that enables the right online distribution model for the insurance industry today. It leverages data and analytics with its smart technology to target loyal customers, building a valuable book of business.”

This new line of equity brings the total funding by Goji to more than $104m. The company’s previous investment was a $19m round last year. The company’s previous investors include: Thayer Street Partners, Coffin Capital & Ventures, Spark Capital, and Five Elms Capital.

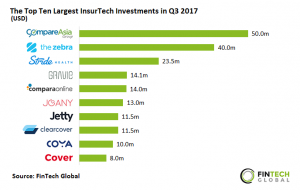

During the third quarter the biggest InsurTech investment went to CompareAsia after it raised a $50m in a round from IFC, Goldman Sachs and Alibaba Entrepreneurs Fund. The next two deals were to The Zebra and Stride Health, which raised $40m and $23.5m, respectively. The next highest deal of the quarter was Gravie’s $14.1m venture round.

Copyright © 2017 FinTech Global