Insurance company Lemonade has closed a $120m Series C funding round led by SoftBank Group, and participation from existing investors.

This fresh batch of capital comes only months after the company received an undisclosed investment from Global insurer Allianz.

New York-based Lemonade is a fully licensed ‘full-stack’ property and casualty insurance carrier, which operates in 25 US states. The app offers homeowners and renters with insurance powered by AI and behavioural economics to reduce costs and paperwork.

One of the company’s newest offerings is ‘Zero Everything’ and offers zero deductible, zero rate hikes and zero depreciation.

These funds will be used by the company to bolster its global expansion efforts for next year.

Lemonade CEO & co-founder Daniel Schreiber said, “The insurance brands we know today came of age in the era of the horse-drawn carriage. But insurance is best when powered by AI and behavioural economics, which is why we believe that companies built from scratch, on a digital substrate and with a social mission, will enjoy a structural advantage for decades to come.”

This equity brings Lemonade’s total funding efforts to $180m since it was founded in 2015. Over the years, GV, Sequioa Capital, Aleph, General Catalyst, Sound Ventures, Tusk Ventures, XL Innovate and Thrive Capital have invested into the company.

Following the investment, SoftBank Group managing director David Thevenon will join Lemonade’s board.

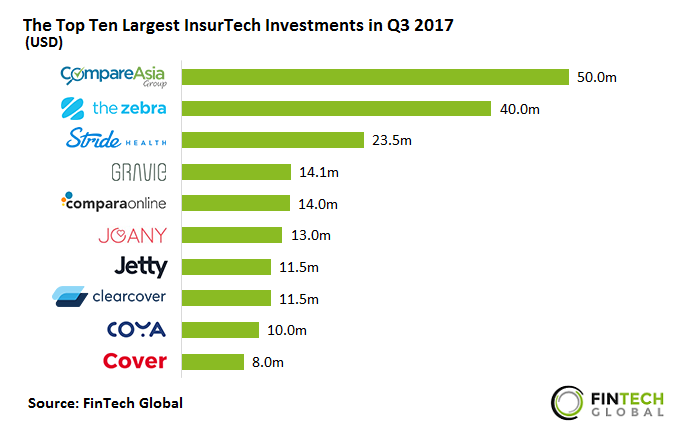

The InsurTech sector has seen a decline in funding this year, due to a smaller amount of large deals. In Q3 2017, the biggest deal was CompareAsiaGroup’s $50m round, with the second highest being just $40m. Lemonade’s Series C has raised more capital than the combined total of last quarter’s top three investments.