LeaseLock, an insurance platform for the rental housing industry, has raised $10m in its Series A round.

The investment was led by Wildcat Venture Partners, with participation also coming from Liberty Mutual Strategic Ventures, American Family Ventures and Moderne Ventures. Investment group Hivers & Strivers made a $1m contribution to the companies Series A.

US-based LeaseLock uses technology to replace security deposits with insurance. Renters pay a monthly $19 fee which insures the property for up to six-times rent and damages.

The platform works by a renter linking their property and bank account for verification, and once they are approved they pay the fees and get coverage. The lease is approved without the need of a security deposit or co-signer.

Proceeds from the round will be used to expand LeaseLock sales and marketing efforts, as well as speeding up product development.

Wildcat Venture Partners founding partner Bryan Stolle said, ?LeaseLock is in the trenches with multifamily executives carefully crafting a product optimized to the needs of enterprise operations, systems and the markets they serve we appreciate this strategic advantage. LeaseLock delivers a best in class product to our real estate network with trillions of dollars in AUM and billions of square feet.

This investment brings the company total funding efforts to $12m. The company prior funding was a $1m seed round from American Family Ventures in late 2016.

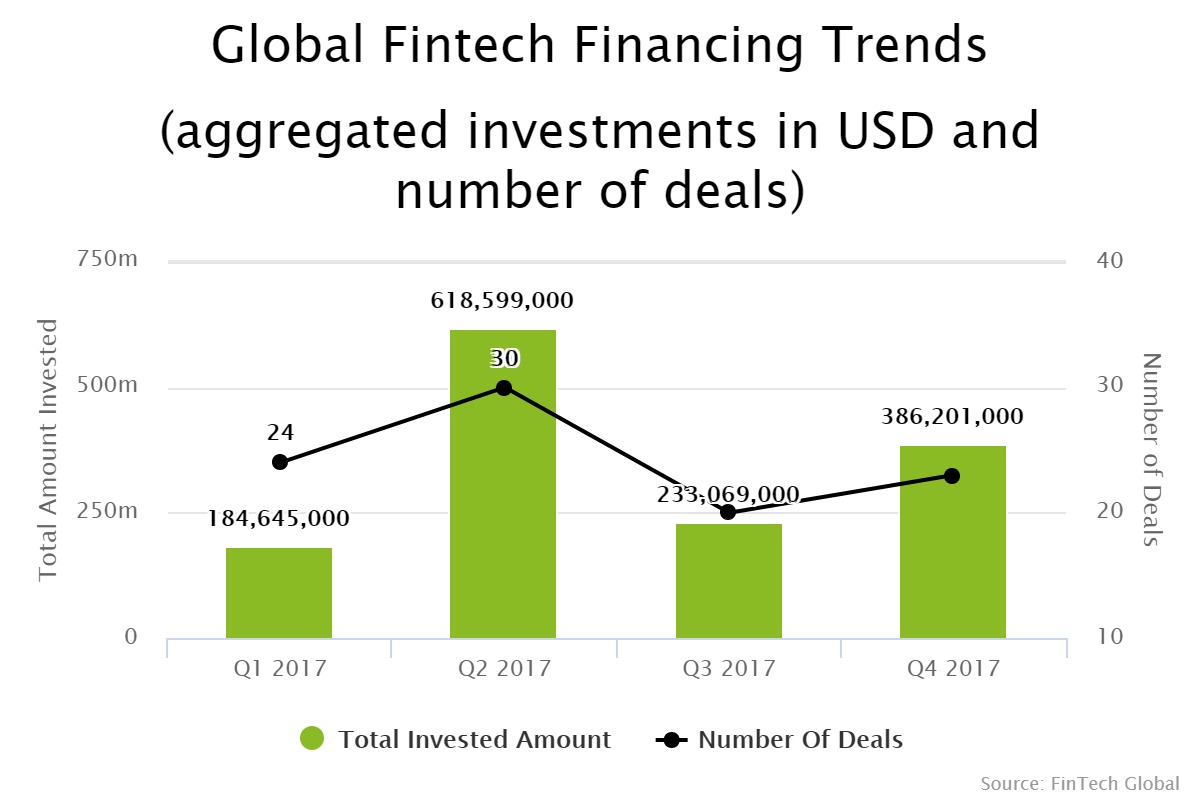

Last year, the global InsurTech sector raised a total of $1.4bn across 97 deals, according to data by FinTech Global.

Copyright ? 2018 FinTech Global

Copyright ? 2018 FinTech Global