Laka, a London-based InsurTech startup, has raised £1.1m to take its product beyond bicycles and into more lifestyle products.

The seed funding was led by Tune Protect Group Berhad, a financial holding company listed on the Malaysian Stock Exchange, with Silicon Valley-based venture capital firm 500 Startups also participating. New and existing angel investors from across the insurance industry also took part in the fundraise.

Founded in 2017, Laka claims to have has developed a ‘unique insurance model’ in which customers only pay for the true cost of cover.

At the end of each month, the cost of claims is split fairly between customers, with the individual’s maximum premium capped at market rate for customer protection.

Laka only makes money when settling claims, which is claims is a ‘fairer business model’ as it passes on savings to the customers.

The product currently focuses on insuring high-end bicycles in the UK. However, the investment will enable it to launch further lifestyle products in the next year.

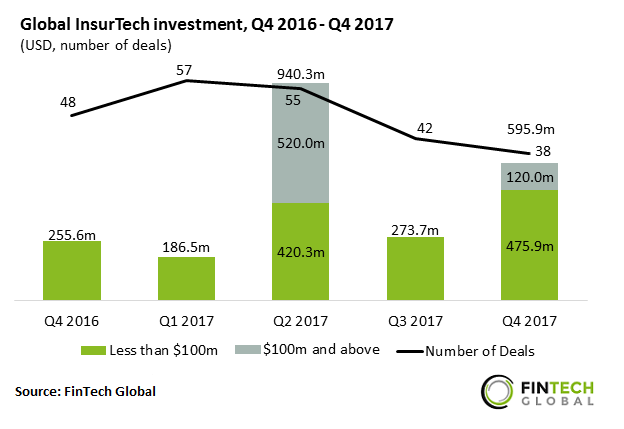

The loss of momentum in global InsurTech investment after 2015 was due to the volatility of large deals. 2015 was a record year for global InsurTech investment with over $2bn-worth of funding. Total InsurTech funding remains variable due to the irregularity of larger deals. However, funding raised from deals valued below $100m has increased steadily every year since 2014 at a CAGR of 21.8%.

Between 2014 and 2016, there was no clear trend towards larger deals. Although deals valued below $1m decreased in share by 5.9 percentage points (pp) in 2015, this value then increased in 2016 to regain most of its original share. Similarly, large deals valued above $25m almost doubled in share between 2014 and 2015, from 9.7% to 16.3%. However, the category’s share then decreased to 9.3% in 2016.

Between 2014 and 2016, there was no clear trend towards larger deals. Although deals valued below $1m decreased in share by 5.9 percentage points (pp) in 2015, this value then increased in 2016 to regain most of its original share. Similarly, large deals valued above $25m almost doubled in share between 2014 and 2015, from 9.7% to 16.3%. However, the category’s share then decreased to 9.3% in 2016.

Copyright © 2018 FinTech Global