Swirl Insurance Services, which uses AI to provide insurance quotes, has reportedly raised $100,000.

The company has so far raised $100,000 of its up to $1.5m convertible note funding round. Swirl was a top 12 finalist in the 2018 Governor’s Business Plan Contest, where it announced its funding round last week. It also in line to receive a portion of the $190,000 in cash and business services awarded to the finalists.

Founder Terry Wakefield said, “We have committed $1.25m, and there is a third investor that has expressed strong interest in investing an additional $250,000, which would take the convertible note raise to $1.5m. We don’t want to raise any more than that because we don’t need any more than that.”

Swirl leverages data from mortgage insurers and large property management firms to issue insurance quotes. Its digital infrastructure allows Swirl Agents to deliver quotes for Homeowner’s, Renter’s, Auto, Pet Health, Specialty and Personal Umbrella Liability Insurance with seconds of loan or residency approval.

Swirl works directly with property management companies, residential mortgage lenders and loan servicers to help their customers buy and retain required insurance products. It claims to do within just a few clicks and in minutes without having to talk to an insurance agent and without the need to complete a redundant and time-consuming insurance application.

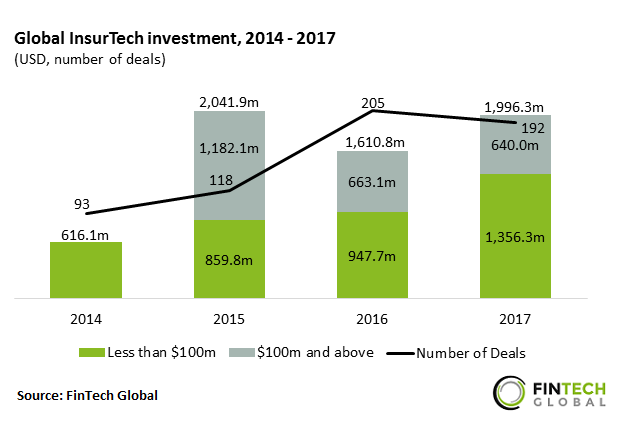

According to a recent report by FinTech Global, global InsurTech funding gained truncation last year with $2bn of capital invested. Despite the increase in total funding last year, deal activity declined by 6.3% compared to 2016.  Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global