On-demand insurance platform Trov has released its end-to-end digital renters’ insurance application which has been built in partnership with Lloyds Banking Group.

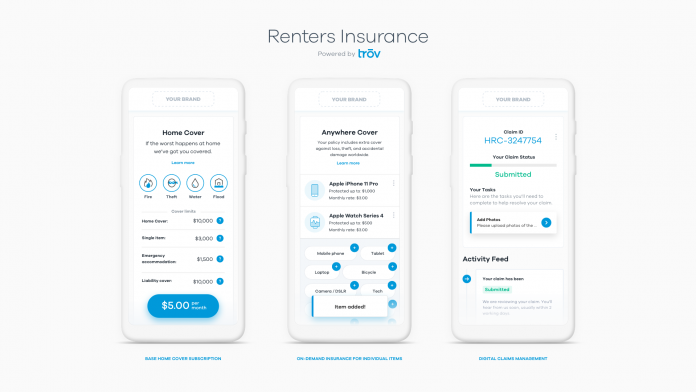

The insurance product includes blanket coverage for items in the home, on-demand insurance for individual items taken out of the house and liability and emergency accommodation cover.

Trov enables renters to activate the base home coverage as a monthly subscription, with the ability to turn on and off protection for certain devices.

Its new service has been brought to market by Halifax Home Insurance, which is part of Lloyds Banking Group.

Halifax has adopted Trov’s back-office modules to help it manage the product. The back-office suite includes a customer relationship manager, claims agent interface and a business intelligence solution for financial reporting and performance analytics.

Trov CEO and founder Scott Walchek said, “By combining an affordable monthly subscription policy with on-demand coverage for personal items, Halifax Renters powered by Trov delivers a modern all-digital experience with unsurpassed flexibility, speed, and convenience.

“Our white-label applications are purpose-built to empower incumbents around the globe to rapidly introduce all-digital insurance products designed to meet the expectations of today’s consumer.â€

This is just one of the new products released by Trov this year. The InsurTech recently partnered with Lloyd’s to build a range of new solutions. Together they have already released a portfolio of end-to-end digital insurance products.

These include four core InsurTech modules for policy sales, claims, client relationship management and business intelligence.

Copyright © 2019 FinTech Global