Personalised insurance platform Setoo will improve its travel insurance offering in the UK through new partnership with European booking platform Omio.

The deal will let Omio, formerly GoEuro, to easily create, distribute and test personalised and transparent insurance policies for individual consumers.

Omio consumers in the UK will now have an option to select bespoke flight delay and cancellation insurance products to ensure trips are fully protected.

Leveraging AI, machine learning and parametric capabilities, Setoo supplies real-time pricing and claims-free products with immediate compensation. Policies include protections for instances such as flight delay, stormy weather, or late train, among others.

Omio commercial director Chris Hall said, “We are delighted to partner with Setoo as we look for new and innovative ways to help our customers travel. I’m excited by Setoo’s innovative approach and I look forward to what the future holds for our customers.”

Setoo recently formed another partnership to bolster its position in the travel insurance market. The InsurTech partnered with online travel agency Im group to help customers access personalised coverage for trips to the UK, France, Italy, Spain, and Germany.

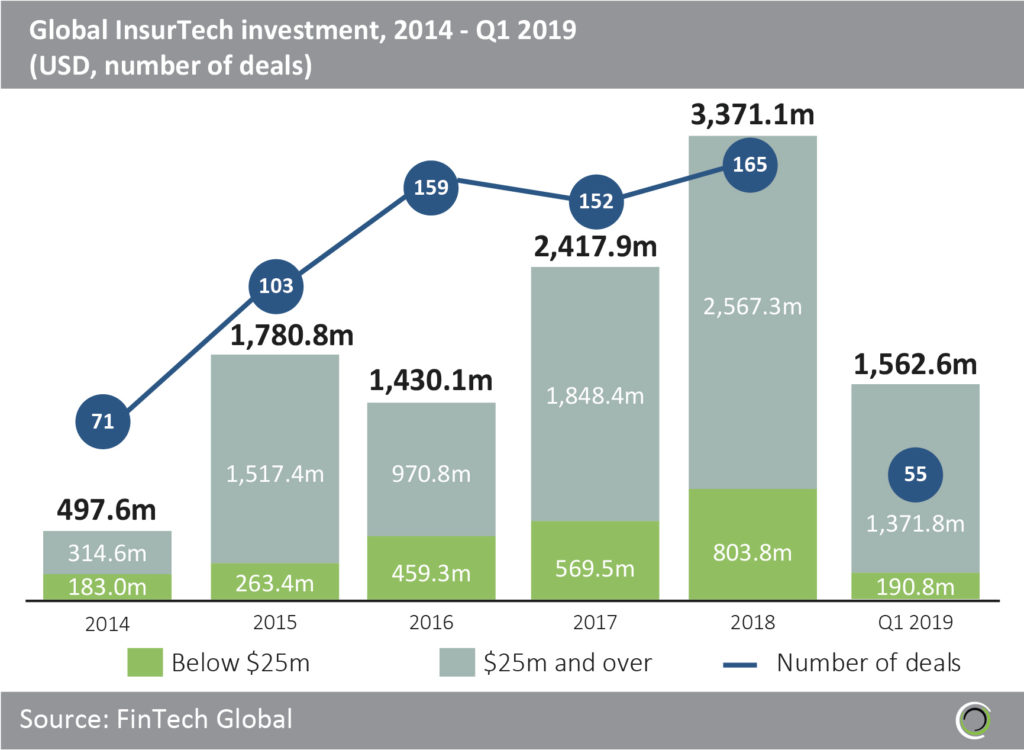

Appetite for InsurTech is still on the rise. Of the $9.4bn has been invested into the InsurTech sector, of which, $3.3bn was invested in 2018 alone, according to FinTech Global data. Even more promising for the sector is the fact Q1 2019 has already seen $1.5bn deployed into InsurTech startups, 46 per cent of total funding raised in the whole of last year.