Insurance is changing and Planck is leading that change through its platform which automatically and accurately assesses risk factors in real time.

Elad Tsur, Amir Cohen and David Schapiro founded Planck in 2016. Tsur and Cohen had previously launched and spearheaded the growth of the data mining company Bluetail until it was acquired by Salesforce in July 2012. Before joining Planck’s founding team, Schapiro had clocked time as the CEO of data analytics company Earnix for almost a decade.

Planck is named after the physical constant in quantum mechanics and has quickly grown to become one of the world’s most promising InsurTech scaleups. It specializes in scraping and analysing huge datasets to quickly and accurately help insurers in their underwriting endeavours.

“The better we can assess risk, the better it is for everybody,” says Omri Yacubovich (pictured), vice president of marketing and business development at Planck. “Consumers will pay the right premium, avoiding cross-subsidizing higher-risk policyholders, and insurance companies can grow new business while reducing loss ratios. It’s not utopia, but a reality for carriers that work with us.”

Having launched the new venture in 2016, the team spent the better part of the following three years developing their minimum viable product. In July 2018, Planck launched its platform for multiple insurance products and business lines. Since then, the scaleup has expanded its offering on a monthly basis.

Not only were insurers pleasantly surprised by how quickly the company’s solution could answer many questions, but they were also amazed by the data’s accuracy. “They had never seen an equivalent performance,” Yacubovich says.

Of course, insurers had already recognized the need for a solution like Planck’s. “Carriers have already identified the need to provide their customers, especially the small- and medium-business segment, with a much better customer experience and faster quoting and onboarding processes,” Yacubovich says. “Carriers also acknowledge the limitations of the existing system using standardization, such as ACORD forms, as well as the limitations of self-declared submissions.”

He explains that the underwriting process has long been a time-consuming one, fraught with frustrations. Firstly, it involved the submission and quoting process from both clients and insurers. Secondly, the existing method usually relied on flawed or incomplete data. Thirdly, the underwriting process was often based on one-size-fits-all questions that could fail to encompass individual clients the way bespoke solutions would.

“In order to overcome the existing obstacles, carriers need to gain access to accurate and up-to-date data to justify the cost of the process compared to the earned premiums, especially in the SMB sector,” Yacubovich continues. “The good news is that the data is out there, and companies like Planck that are experienced in dealing with big data and artificial intelligence are already helping carriers gain a competitive advantage, allowing them to grow their [slice of the] pie by entering categories that were less profitable in the past, provide a better user experience, reduce underwriting expense ratios and improve overall loss ratios.”

So how can modern solutions provide greater flexibility to the underwriting process? In Planck’s case, it starts with the underwriter, an agent or a customer simply entering a business name and address. “The business name could be a DBA, [doing business as]. It could be a registered name. It can be anything that describes the business,” Yacubovich says.

He adds that Planck has built a proprietary technology that allows it to identify the business even with partial or typo-riddled information.

Once the client has entered a business’s name and address, Planck’s technology crawls through thousands of open web data sources to find out everything it can about the company. “Anything that’s out there,” Yacubovich says, “we scrape the internet and we get all the relevant data for that specific entity.” But that’s only the beginning of the process.

But having the data is not enough – insurers must be able to consume it in a way that provides them clarity about the risk and allows them to action it. And that’s where the processing and insight creation phases kick in. The scraped data is analysed through a combination of image processing, natural language processing, unstructured data analysis and other artificial intelligence technologies. “[Through that,] we’re able to extract valuable information out of the various data pieces,” Yacubovich says.

For instance, a selfie taken in a restaurant may be enough to find out whether the establishment has smoke detectors or sells hard liquor, or if the floor looks particularly slippery. Having information like this could, for example, empower underwriters to more accurately assess the risk of injury in a dancing area in a bar.

Once extracted and analysed, the data is taken through the third phase, which is where Planck’s technology creates the insights underwriters need. “We use deep learning algorithms that we train based on gold data, as in data already proven to be 100% accurate,” says Yacubovich. “So, we can train our algorithmic model to find the truth from all the different data pieces that the system has processed. During the third phase, the system takes all the extracted information and then creates the truth per field or per question that we are trying to address.”

Traditionally, underwriters also conduct their own online research. However, Yacubovich explains that these findings and the subsequent analysis may be biased. Comparatively, Planck’s technology can scan all the data available to the public. “But instead of asking hundreds of questions or dozens of them, which would take hours to complete, and even more to be validated by the carrier, that can be completed within seconds,” Yacubovich continues.

With better information, Planck envisions benefits for carriers and customers alike. “The immediate upsides are more accurate quoting and lower pricing for the lower-risk policies,” he says. “I also believe that such a future will change the nature of underwriters’ work. Artificial intelligence alone won’t be able to achieve it, but I believe that underwriters, just like smart detectors, will provide the artificial intelligence with possible input, such as predictors they identified in a particular case.”

And when they do, the algorithms become smarter too. “The artificial intelligence that wasn’t trained for that particular example will evaluate the actual attribution of that factor and make a decision about whether to include it as part of the risk assessment model,” Yacubovich continues. “Furthermore, it will search for additional look-a-like predictors to further enhance its relevance and accuracy.”

Planck’s technology also enables insurers to quickly react if a customer’s risk profile changes. This enables smoother and more streamlined renewal processes by minimizing low-value-add data activity, allowing the underwriter to focus on new risks, coverages and exposures.

The way Yacubovich sees it, solutions like Planck’s will fundamentally transform the insurance industry. “In the future, carriers will underwrite and define pricing based on risk types and the overall probability for each of the policy’s related risks, given the known and unknown factors combined with the deviation from similar businesses, so they don’t need to identify and evaluate any particular field or potential predictor based on generic standards or their own experience,” he says.

“For example, the risk of robbery could be related to operational hours, but also to the amount of cash or valuables stored in the business and possibly even to the proximity to certain other businesses or institutions. Also, the overall reported crime in the area can contribute to the predicting model, and so forth. I believe that down the road, instead of asking generic questions about the hours of operation and valuables or cash stored in the business at any given time, the carrier will be able to receive specific, customized risk probabilities and use those to price and issue quotes.”

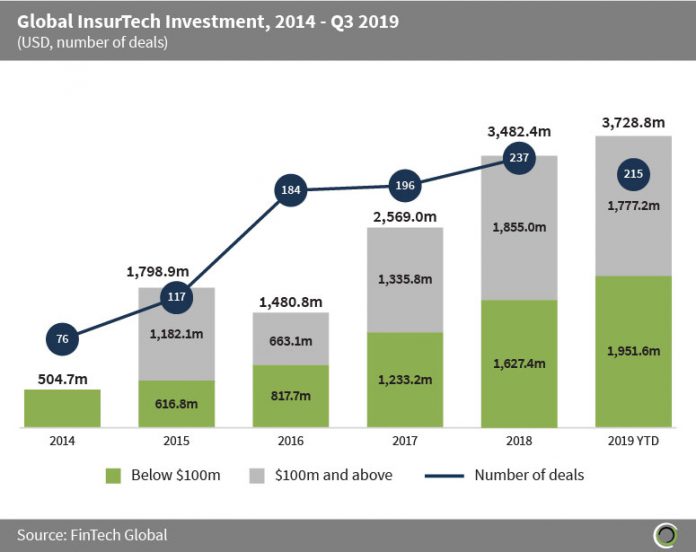

The InsurTech scene has grown tremendously in the past six years. In 2014, the global industry attracted $504.7m, according to FinTech Global’s data. By 2018, that figure had jumped to $3.48bn only to skyrocket to $3.72bn in the first three quarters of 2019 alone. With so much money being spent on innovation in the industry, one must wonder where that leaves underwriters.

Yet, Yacubovich doesn’t think underwriters need to look for new jobs any time soon. “We’ve seen this shift in many other industries,” he says. “Even in traditional industries like farming, instead of seeding, planting and watering based only on the farmers’ knowledge and experience, farmers have started using mechanical vehicles and equipment that do the same much more efficiently and accurately. Nowadays, farmers are using IoT devices to get even more accurate and profitable. However, they are still farmers.

“The technology advancement hasn’t replaced the need for a farmer to define how much water each seed requires at different times of the year or the exact time to seed a plant in a certain type of soil. It has enabled them to be better at what farmers have been doing successfully for centuries, at larger scales.”

Speaking of the future, what is next for Planck? Having launched only three years ago, the company has already set up shop across two continents. But it is just the beginning. “Right now, we’re laser-focused on growth and covering more insurance questions,” Yacubovich concludes.

Copyright © 2019 FinTech Global