Nigerian FinTech Carbon has signed a partnership with insurer AXA Mansard to launch a range of healthcare benefits for its regular customers.

The idea is that customers that save a minimum of N3,000 ($7,67) per month with Carbon will qualify for a N20,000 ($51.31) cash benefit in case they are hospitalised for two or more nights. Customers that also have an existing loan that is not in arrears or do over N5,000 ($12.78) in transactions with Carbon will also qualify for this health benefit. These benefits are currently only available in Nigeria.

Carbon also announced new measures to ease the financial burden caused by the ongoing coronavirus. As well as providing customers who pay their loans on time with access to the new healthcare benefits, Carbon is rescheduling loans for eligible customers who experience difficulty paying back their loans. Users will also be able to make up to 30 fee-free transfers on the platform.

?Our main aim as a business is to empower our customers to live a life of dignity and prosperity,said Ngozi Dozie, co-founder of Carbon. ?Whether that is by rewarding their discipline and loyalty or by adjusting the terms of their loans, we are committed to seeing them thrive and flourish. That is why we have rolled out these benefits and announced the new measures. We want to ensure that they have the best support and access to life-changing services, even at this difficult time.p>

Ngozi Dozie co-founded Carbon in 2012 under the name Paylater together with his co-founder Chijioke Dozie. Speaking exclusively with FinTech Global, Chijioke Dozie recently revealed the challenges they had to overcome including creating consumer trust in a country where people didn’t trust banks in order to make the startup a success.

In an effort to boost confidence in the FinTech sector and to highlight how the industry can be trusted, Carbon did something essentially unheard of among Nigeria FinTech startups in July by releasing its audited financials to the public. ?We want our employees and potential employees to know that we are achieving success and are set to continue to achieve success,Chijioke Dozie explained the decision.

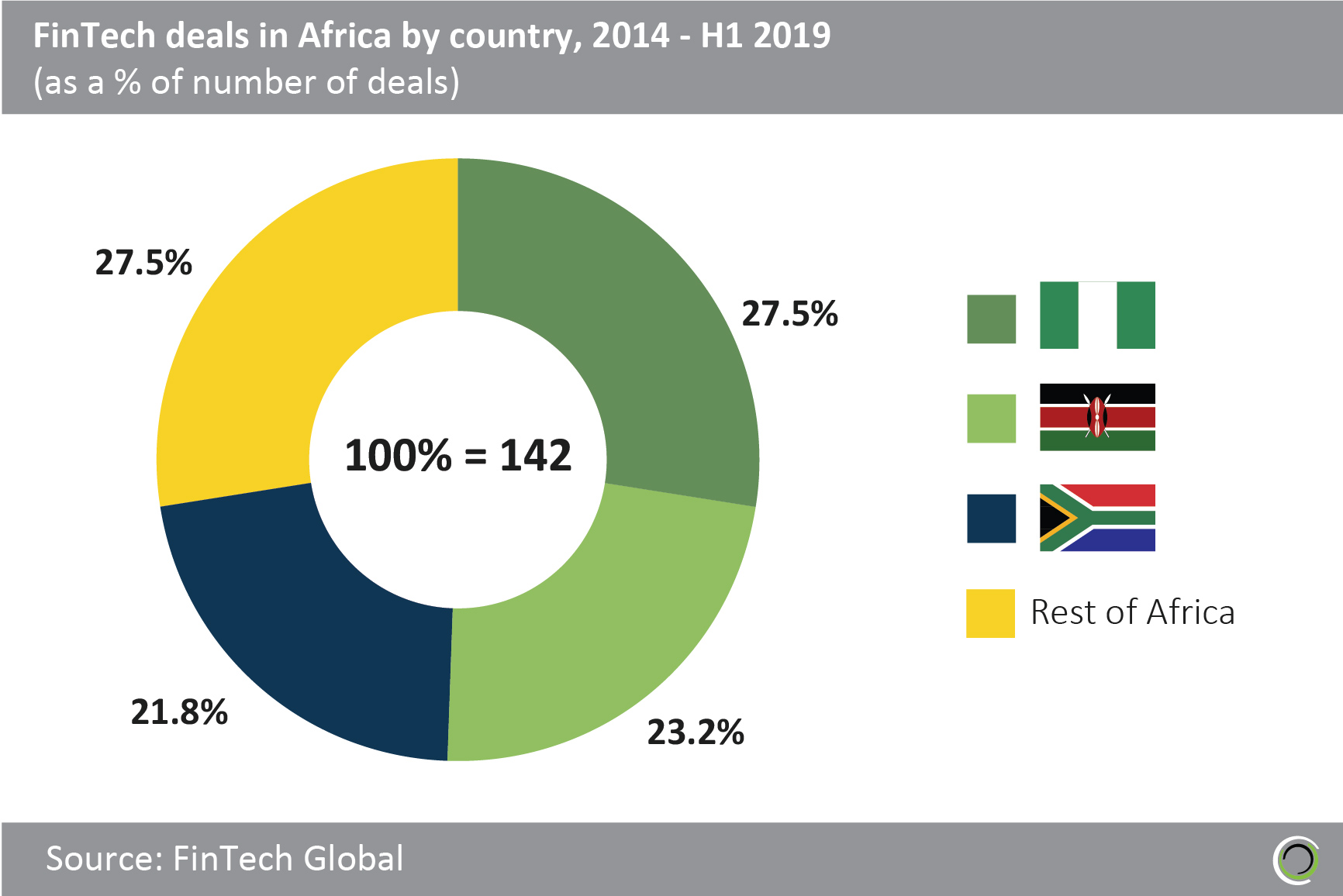

FinTech Global has previously highlighted Nigeria’s position as a leader of Africa FinTech revolution. The country is one of the three top receivers of this capital, having received 27.5% of the total FinTech investment going into the continent between 2014 and the first half of 2019. Kenya and South Africa had seen 23.2% and 21.8% injected into them respectively during that period.