Canadian Holt Fintech Accelerator has announced the eight FinTech companies to join its 2020 cohort.

The FinTech accelerator’s third batch has taken the ongoing pandemic under particular consideration and identified four key verticals for which Canada’s ecosystem has shown a considerable appetite.

These are cybersecurity, InsurTech, PropTech and trade finance. This is hardly surprising as FinTech Global has reported in the past that both cybersecurity and InsurTech ventures could enjoy a boom due to the coronavirus.

“In response to Covid and the world coming to a near halt, we felt that our society needed to accelerate the adoption of FinTech solutions more than ever,” said Jan Christopher Arp, founding managing partner at Holt Fintech Accelerator.

“In adjusting our focus to the needs of our society, we witnessed a record number of applications, alongside an increase in our advisor engagement. This enabled us to find the best FinTech startups that will provide direct benefits for Canadian consumers, financial institutions and service providers, while also enabling Canada to become more competitive globally.”

This year’s cohort will feature eight companies from seven countries.

First out is the Brazilian startup Agryo, which connects lenders to farmers by combining data and AI modelling to bring better financial services to millions of underserved farming families globally. Its risk intelligence tools provide analysis before, during and after any transaction related to crop contracts dating back 20 years. They provide risk intelligence as service (RasS) to banks, agricorps, insurers and Ag-coops.

Next up is the London-based startup Naoris, which is set up to help financial service companies future proof their systems and data the way governments and militaries approach cybersecurity and threat detection.

Calgary-based venture Ownest has so far partnered with 125 Canadian lenders to make shopping for a mortgage, car financing or other loans as easy as ordering dinner, slashing the paperwork and increasing transparency.

Boston-based InsurTech company Relativity6 has developed tools to help insurers sift through the massive amounts of data they hold to identify and retain profitable customers, cross-sell and up-sell at the right time. The AI-powered platform also helps predict customer behaviour.

The next InsurTech on the list is New Zealand-based Sentro. It offers a solution that empowers group insurers to grow their business efficiently by connecting their customers, partners and systems. It is already a part of the Microsoft for Startups programme.

PropTech SolidBlock is an Israel-based startup that addresses a serious lack of liquidity in real estate. Tokenization of such assets, smart contracts with built in regulation and legal structuring and a blockchain based, tradable asset infrastructure.

Nova Scotia-based Talem Health Analytics offers a predictive AI injury causation tool which examines car crash data for severity, diagnosis confirmation, occupant motion, and recovery trajectory. This helps insurers streamline recovery and cut down on billions in fraud each year.

Last one out is the Swiss-based company Fidectus allows energy traders to manage the high pressures of managing costs, cash, limits and risks by automating and accelerating the settlement process in cross-company workflows.

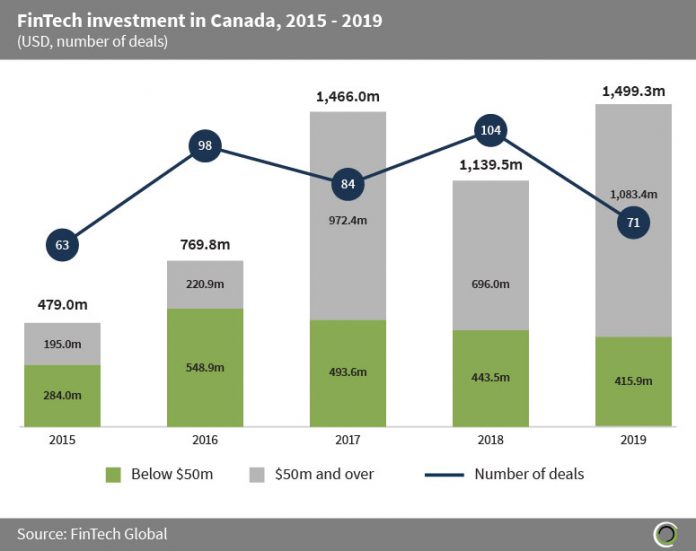

The news about Holt Fintech Accelerator’s latest batch comes as Canada’s FinTech sector has enjoyed several years of impressive growth. For instance, back in 2015, the sector only raised $479m in total, according to FinTech Global’s research. Fast forward to 2019 and that figure had jumped to $1.49bn.

For instance, Luge Capital is a new FinTech venture capital firm that raised a $85m fund last year to support the nation’s FinTech companies.

Speaking exclusively with FinTech Global, Luge co-founder Karim Gillani recently identified three reasons as to why Canada’s FinTech sector has been growing: access to more capital, increased integration between big businesses and startups and, thirdly, growing support from the governmental policy makers.

Copyright © 2020 FinTech Global