InsurTech and cybersecurity companies were among the 34 FinTech companies that raised money last week, but Covid-19 continues to haunt the industry.

FinTech businesses in the payments, buy now pay later and RegTech industries have continued to reap successes despite the fallout of the coronavirus.

However, while many enterprises in the FinTech industry have raised money over the last 12 months, investment levels in many sectors have dropped despite those successes.

For example, by the end of the third quarter of 2020 it seemed as if the WealthTech industry was on the path of experiencing its first decline in investment in years. It had suffered 5.1% lower investments over the first nine months of the year compared to the same period in 2019.

Between January and September 2020, WealthTech companies around the world raised $6.1bn. The sector raised $8.6bn in total in 2019.

A similarly tainted picture can be painted for the two sectors that enjoyed the biggest wins last week: the cybersecurity and the InsurTech industries.

Let’s start with the cybersecurity sector. In the past seven days, FinTech Global reported how Swimlane, Qohash, L7 Defense, Build38 and ToothPic have all topped up their accounts with new funding.

It should hardly come as a surprise that the cybersecurity sector has seemingly fared well despite the coronavirus. In fact, some of the growth of the sector may even be attributed to the pandemic.

As governments around the world introduced social distancing rules last year, people began to work remotely. Not only did this mean that many had to juggle home schooling with their hectic professional schedules, but they also found themselves separated from the digital defence infrastructure their employers had in their offices.

That included both the technology put in place to protect them as well as the input they could get from their colleagues. Employees could no longer turn around to a co-worker and ask about any weird emails or other anomalies.

In short, businesses’ defences against cyber criminals were compromised as people started to work remotely. Bad actors have taken advantage of the situation. The number of hack attacks, phishing schemes and other financial crimes skyrocketed in 2020.

Consequently, corporates faced a need to upgrade their cybersecurity. “The unprecedented shift to remote working from March resulted in strong demand for endpoint security to protect new company-deployed notebooks, as well as consumer-owned devices used as part of business continuity measures,” said Matthew Ball, chief analyst at Canalys, when recently commenting on the situation.

However, there are signs that the cybersecurity boom may be cooling down. Despite the rising threats caused by Covid-19, investment into the cybersecurity sector only reached $700m in the second quarter, representing a decline of over 60% from the first three months of 2020, according to FinTech Global’s research.

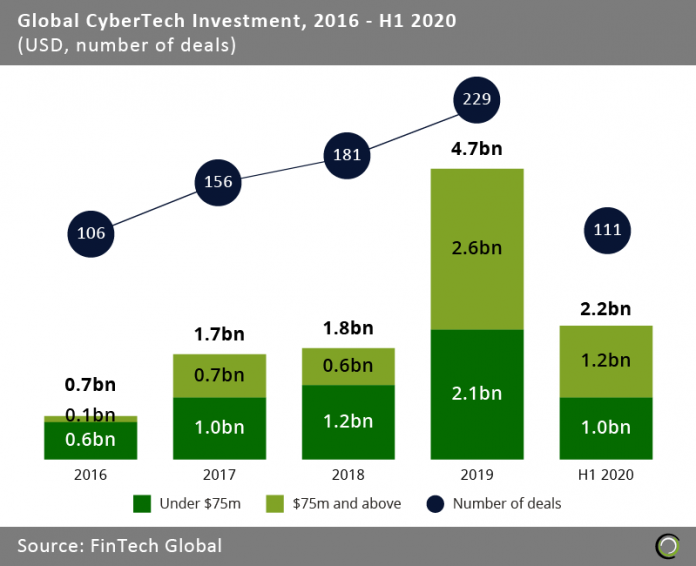

The drop came after several years of considerable growth. The sector only attracted $700m in funding in 2016. Fast-forward to 2019 and that figure had jumped to $4.7bn.

The drop came after several years of considerable growth. The sector only attracted $700m in funding in 2016. Fast-forward to 2019 and that figure had jumped to $4.7bn.

The decline could be partially due to investors feeling hesitant in backing new ventures in the midst of the market uncertainties caused by the coronavirus, according to recent research by Canalys.

Another reason is that businesses simply grew reluctant to invest in their cybersecurity infrastructures when their overall revenues could be compromised because of the pandemic.

Nevertheless, others are predicting that the cybersecurity sector will continue to grow once the smoke clears. A report from Grand View Research expects that the global data protection as a service market is expected to grow considerably in the next seven years, reaching a whooping $103.8bn in 2027, growing at a compound annual growth rate of 31.3%.

So, while there is certainly cause for concern, there is also reason to be optimistic.

A similarly complex picture also applies to the InsurTech industry. Last week FinTech Global reported how companies like Digit Insurance, Lovys, LeoCare and Arbol raised additional funding to fuel their growth.

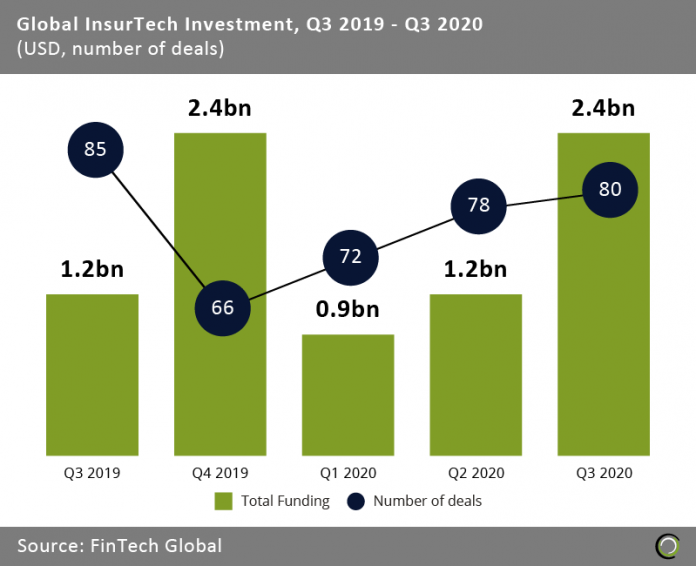

Contrary to the cybersecurity sector, the InsurTech industry has continued to enjoy a steady stream of investment over the past year. Global InsurTech funding recorded its second consecutive quarter of growth in Q3 2020. Businesses in the industry raised nearly $2.4bn during the period, double from the $1.2bn raised in the second quarter.

Moreover, ventures like Lemonade and Root Insurance went public in 2020, adding to the bullish attitude of the InsurTech industry in general.

Moreover, ventures like Lemonade and Root Insurance went public in 2020, adding to the bullish attitude of the InsurTech industry in general.

Early on in the pandemic, FinTech Global discussed the potential future of the industry with sector stakeholders. Many of them believed that InsurTech startups would be the big winners to come out of the crisis.

Simply put, the argument was that Covid-19 had exposed the weaknesses in insurers’ structures. As the sector has been relatively slow to adopt new technologies compared to the financial sector, they needed to turn to entrepreneurs and innovators to jump-start their digitalisation efforts.

“Where insurance companies need to adapt fast InsurTechs are well positioned to allow insurance carriers to adapt rapidly,” Samuel Falmagne, CEO and co-founder of Akur8, the InsurTech company, told FinTech Global at the time.

Even though startups were identified as vital for the insurance revolution, their survival is not guaranteed. Over the years, more and more investment has been funnelled into larger and larger deals.

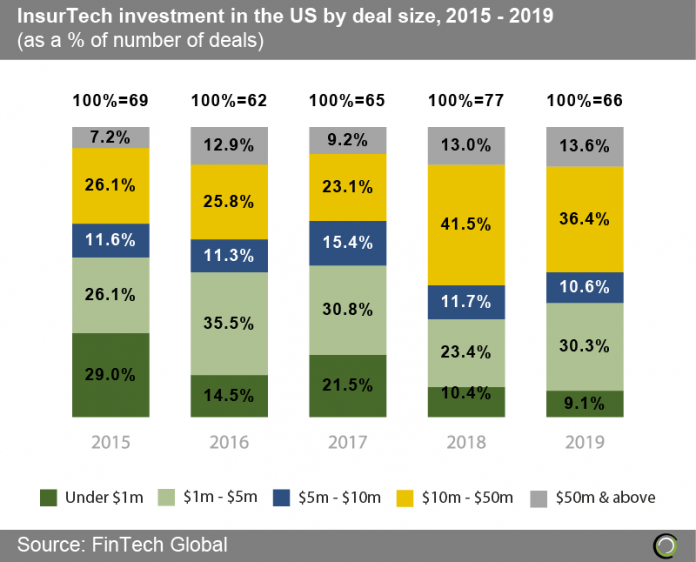

Deals worth over $10m represented 33.3% of the total investment into US InsurTech companies in 2015, according to FinTech Global’s research. That figure had grown to 50% in 2019. Comparatively, deals worth under $1m dropped from 29% in 2015 to 9.1% in 2019.

On the one hand, this is expected as the sector matures. On the other, it may mean that investors, who are usually hesitant in investing into brand new startups, could become even more reluctant to do so. If their eagerness to inject new capital into new ventures had already cooled down before the pandemic, then the market uncertainties adding more risks to their investments could mean InsurTech startups will have an even harder time raising capital.

On the one hand, this is expected as the sector matures. On the other, it may mean that investors, who are usually hesitant in investing into brand new startups, could become even more reluctant to do so. If their eagerness to inject new capital into new ventures had already cooled down before the pandemic, then the market uncertainties adding more risks to their investments could mean InsurTech startups will have an even harder time raising capital.

No matter how you cut it, it seems as if Covid-19 will continue to affect the FinTech industry for some time to come.

PPRO secures $180m and achieves unicorn status

Local payments platform-as-a-service PPRO has raised a $180m funding round and achieved a valuation of more than $1bn. Eurazeo Growth, Sprints Capital and Wellington Management all backed the raise. PPRO will use the money to fund its further global expansion and support the development of its border-free payment technology and services.

TripActions raises $155m Series E

Business travel and spend management platform TripActions has bagged $155m in its Series E funding round, pushing its valuation to $5bn. Andreessen Horowitz led the raise. Zeev Ventures, Lightspeed Venture Partners and Greenoaks Capital also participated in the funding round.

TripActions will use the funds to improve its platform which is set up to empower businesses to manage their business travel in a single location. Users can build and manage all of their corporate travel to ensure employees are safe, costs are controlled and money can be saved.

Paystone rakes in $69m in equity and debt

Payments and integrated software company Paystone has finalised a $69m strategic financing round from Canadian Business Growth Fund (CBGF) and National Bank of Canada. This round was comprised of equity and debt, with the latter being provided by the National Bank of Canada. The funds have been earmarked to help Paystone boost its customer engagement services and deepen its electronic payment processing solutions.

Quantile Technologies raises $51m minority investment

Portfolio optimisation service provider Quantile Technologies has scored a $51m minority investment from growth equity firm Spectrum Equity. With this capital, the FinTech hopes to accelerate its next phase of growth, which includes developing new services and expand into new markets. Spectrum is the first institutional investor to back Quantile.

Indy secures $42.6m Series B

French FinTech startup Indy has added $42.6m to its coffers on the back of a Series B round and changed its name. It used to be known as Georges.tech. The company, which has created an accounting solution, will use the cash influx to fund the launch of its services in the US.

Swimlane closes $40m round to support global expansion

Swimlane, a security orchestration, automation and response solution, has secured $40m in a new funding round. EIP acted as the lead investor. With this capital injection, the company plans to create more partnerships and alliances, expand its research and development efforts, and further its global expansion. As part of the deal, Swimlane has named James Brear, the former CEO of Veriflow, as its new CEO.

brigit said to close $35m Series A

Personal finance app brigit has reportedly collected $35m in its Series A round to help it expand its operations. The capital infusion was led by Lightspeed Venture Partners, with commitments also coming from DCM, CRV, Secocha, Hummingbird, Brooklyn Bridge Ventures, Nyca, Core Innovation Capital, Canaan, Abstract, Shasta, DN Capital, Flourish Ventures and Ashton Kutcher’s Sound Ventures. With the funds, the FinTech to expand its operations and further the reach of its business.

Elinvar scores €25m in funding round

Berlin-based Elinvar has netted €25m in a new funding round, which will help the WealthTech scale its multi-tenant platform. Toscafund Asset Management led the investment round. Existing shareholders Ampega Asset Management, finleap and Goldman Sachs also contributed to the raise.

Moss closes $25.5m funding round

Moss, a corporate credit card builder, has raised $25.5m in a new funding round. Valar Ventures served as the lead investor, with participation also coming from Cherry Ventures and Global Founders Capital. The Germany-based company Moss aims to replace expense reports through unlimited virtual and physical credit cards. Businesses can control their employee spending, automate accounting, manage subscriptions, track spending in real-time, set budgets and more.

Quantifind secures $22m round

Quantifind is a provider of solutions that use data science to help automate financial crimes investigations. Now it has gained some financial muscles to boost its services on the back of raising a $22m round. The anti-money laundering and fraud investigations tech company will use the funds to fuel the growth of sales and marketing initiatives and to keep developing its platform.

Trovata collects $20m in its Series A funding round

Open-banking platform Trovata has collected $20m in its Series A funding round, which was led by Wells Fargo Strategic Capital. With this equity infusion, the FinTech will build new services, add more bank distribution partners and accelerate adoption of its multi-bank APIs around the world.

PropTech Exporo secures $19.48m in investment round

Hamburg-based Exporo has secured $19.48m in new funding round, bringing the total raised by the PropTech to over $91m, including €8m raised in 2017.

Exporo has created a platform connecting real estate developers with investors and enjoyed the new cash injection from existing investors.

Digit Insurance secures $18.5m round

India-based InsurTech company Digit Insurance has joined the unicorn club after the close of a $18.5m funding round, which pushed its valuation past the $1.9bn mark. Contributions to the round came from existing backers A91 Partners, TVS Capital and Faering Capital. Digit Insurance is planning to use the capital boost to invest into its processes and technologies as well as meeting regulatory requirements.

Lovys said to raise €17m in funding round

Mobile-based insurance platform Lovys has netted €17m in its Series A funding round. The investment capital was supplied by Heartcore, NewAlpha, Raise Ventures and existing backers Maif Avenir, Portugal Ventures and Bpifrance. The InsurTech startup will use the money to expand internationally, increase the size of its team and improve customer experience.

LeoCare nets €15m in new funding round

InsurTech startup LeoCare has reportedly netted €15m in a funding round, which was backed by Felix Capital, Ventech and Daphni. The InsurTech is planning to release a range of new tools in the future, including a bot that will let users check the status of their cases. It is also building a tool that will send a notification whilst driving if the area has a lot of accidents.

Valtix bags $12.5m in funding round

Cloud-native network security platform Valtix has bagged $12.5m in its strategic funding round to boost its go-to-market strategy. The capital was supplied by Cisco Investments, Northgate Capital and The Syndicate Group. They join the company’s existing backers Trinity Ventures, Vertex Ventures and Wing Venture Capital. These extra funds will accelerate the company’s go-to-market strategy and enable it to scale during 2021.

X1 Card secures $12m in round supported by Jared Leto

X1 Card, which claims to be the smartest credit card available, has scored $12m in its latest funding round. Spark Capital led the raise. Additional support to the round came from actor and musician Jared Leto, Box CEO Aaron Levie, Yelp CEO Jeremy Stoppelman, Affirm CEO and PayPal co-founder Max Levchin and Y Combinator Continuity CEO Ali Rowghani. This equity comes after the card’s rapid adoption, which has seen its waitlist reach around 300,000 since opening in September 2020.

Tradeteq adds $9.4m to its coffers via Series A round

WealthTech Tradeteq has secured $9.4m in a Series A round designed to fuel the further development of its product development. The startup has created a bank asset distribution platform that provides credit insurers, banks and asset managers with a way to streamline asset distribution and reduce friction cost.

wealthpilot closes €8m round to improve data aggregation capabilities

Software-as-a-service platform developer wealthpilot has bagged €8m in a funding round. It will use the money o improve its data aggregation capabilities. Of the capital, €3.4m was supplied by Seventure and the remaining funds were supplied by Bayern Kapital, MIG Fonds and a consortium of business angels.

Arbol raises about $7m in Series A

InsurTech Arbol a Series A fundraising round worth about $7m. No exact number was given. Arbol boasted that its Series A round was oversubscribed and completed at a significant increase in valuation from its initial seed round. All of the company’s original seed investors, including Finch Finance LLC and Space Capital, recommitted for the Series A round, in addition to one new investor Mubadala Capital.

Qohash secures $6.2m in new capital injection

Data security startup Qohash has secured $6.2m in its Series A funding round to help it expand across North America. FINTOP Capital led the investment round. As part of the deal, FINTOP Capital general partner John Philpott will join the Qohash board of directors, alongside Coveo president and CTO Laurent Simoneau. With the burst of equity, Qohash is hoping to expand across North America and accelerate its commercialisation.

Tamara secures $6m in new investment round

Saudi Arabia-based startup Tamara has secured $6m of seed capital on the back of increased activity in the BNPL sector. Impact46, a certified B Corporation describing itself as being dedicated to social impact, led the raise. Vision Ventures, Wealth Well, Seedra, Khwarizmi, Hala and Nama along with multiple family offices also backed the round.

L7 Defense closes $4m seed round

Cybersecurity platform L7 Defense has closed a $4m financing round, which will help it bolster its marketing and business development efforts. TRUMPF Venture led the raise. Quick Heal Technologies also backed the round. L7 Defense will use the equity burst to bolster its leadership, its marketing and business development activities and extend its market reach.

Build38 closes €3m pre-Series A round

Mobile app security platform Build38 has secured €3m in its pre-Series A funding round to support its market expansion. The investment was co-led by Caixa Capital Risc and eCAPITAL ENTREPRENEURIAL PARTNERS. Existing investor G+D Ventures also participated in the raise. Build38 earmarked the funds from the round for its European and Asian expansion efforts. The startup will also use it to fund the capabilities of its security solution and mobile fraud protection capabilities with more AI functions.

Volopay closes $2.1m funding round

Volopay, which supplies companies with a financial control centre, has reportedly collected $2.1m in funding. Tinder co-founder Justin Mateen served as the lead investor, with commitments also coming from Soma Capital, CP Ventures, Y Combinator, VentureSouq, the founders of Razorpay, Antler and other angel investors.

CreditEnable closes $2m pre-Series A

CreditEnable, a digital marketplace for SME finance, has reportedly collected $2m in its pre-Series A round. With this equity, the company will enhance its technological infrastructure and grow its user base. The equity was led by Venture Catalysts. CreditEnable is a marketplace for SME credit, helping to better connect lenders and borrowers.

Finance Unlocked bags £1.75m in funding

Finance Unlocked has bagged £1.75m in its new funding round. The capital injection comes after the FinTech experienced a user growth of 2,800% in 2020. This growth was driven by the impact on the workplace caused by the Covid-19 pandemic. Banks, asset managers and law firms use Finance Unlocked’s platform to educate people on the financial world.

Nayms said to raise £1.5m in funding

Nayms, which empowers cryptocurrency investors to reinsure crypto-risk, has reportedly netted £1.5m in seed equity. XBTO served as the lead investor, with participation also coming from Coinbase Ventures, Maven11, InsurTech Gateway and the founders of Synthetix.

Pace Enterprise said to close seven figure funding round

BNPL solution Pace Enterprise has reportedly secured a seven figure seed funding round. The capital injection was co-led by Vertex Ventures and Alpha JWC. With this capital burst, the FinTech hopes to expand its platform and build new solutions to its clients.

ToothPic bags €810,000 in its latest funding round

ToothPic, which builds security and usability of authentication processes, has closed its second funding round on €810,000. The capital will be used to support the RegTech’s growth in the cybersecurity space. The funds were supplied by Club degli Investitori and Vertis Venture 3 Tech Transfer Fund.

Finqware closes €500,000 in seed funding round

Romanian FinTech Finqware has netted €500,000 in a seed round led by Elevator Ventures. The open banking startup’s raise was also backed by GapMinder VC and will be used towards further expanding the company’s reach.

Quirk closes £300,000 pre-seed round

Quirk, which leverages a personality test to offer tailored financial advice for young professionals, has bagged £300,000 in pre-seed funding. The capital was supplied by SFC Capital and unnamed angel investors. With this burst of funding, the company will grow its team, expand its product offering and bolster its offering.

Navis Capital Partners invests in Moneythor

Digital banking solution Moneythor has raised a new funding round from investor Navis Capital Partners. However, both parties remain tightlipped about the amount or the other details of the deal.

Ziina closes its seed round

UAE-based peer-to-peer payment application Ziina has closed its seed round to help with its goal of entering Saudi Arabia and Jordan by 2022. Jasoor Ventures led the raise. Wamda, Class 5 Global, Long Journey Ventures, Graph Ventures, Jabbar Internet Group and FJ Labs supported it.

Following the close of the round, Ziina hopes to increase its product offering to serve more freelancers and small businesses. Funds will also be used to grow its team, extend its footprint and enter the Saudi Arabia and Jordan markets by 2022.

Copyright © 2021 FinTech Global