Amplify Life Insurance, a provider of permanent life insurance, has collected $2.5m in its seed round.

The investment was led by Anthemis with commitments also coming from Transverse Ventures Fund.

Founded in 2019 by Qiyun Cai and Hanna Wu, the company hopes to help consumers build wealth through permanent life insurance. Its platform offers life insurance products that also enable holders to access tax-free investments. The aim is to help generate wealth to be used for retirement, student loans and other upcoming expenses.

Consumers can customise their policy to meet their needs and an educational customer journey ensures all types are customers feel supported.

The company launched its maiden customer-facing platform in early 2020 and has since submitted multiple seven figures of annual premiums. It also claims to be contracted with several large life insurance carriers.

Amplify Co-founder and CEO Hanna Wu said, “Permanent life insurance is traditionally sold face-to-face by commission-driven life insurance agents.

“Today, Amplify is taking the first step in providing a transparent and streamlined digital-first experience for consumers to purchase permanent and cash value life products. We see a huge opportunity to transform the future of life insurance by bridging health and wealth to improve the lives of millions of people.”

The InsurTech company’s previous funding round was closed in March 2020.

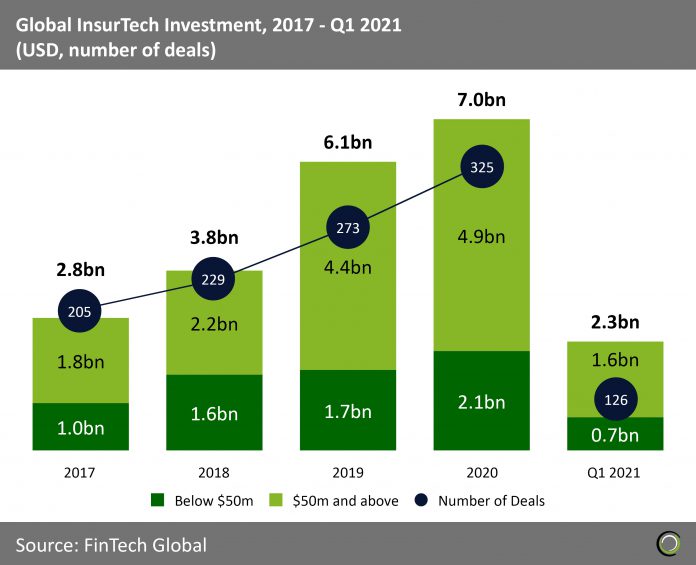

Global investment into the InsurTech sector reached new heights in 2020. A total of $7bn was invested through 325 deals around the world, according to data from FinTech Global. This marked a slight increase in 2019’s funding levels, which reached $6.1bn through 229 transactions.