The European InsurTech deals sector suffered a sharp downturn in fortune in 2023, but the United Kingdom (UK) remained the pre-eminent force on the continent.

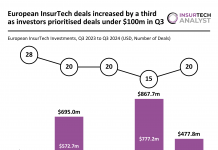

The realm was marred by a substantial decline in both deal activity and investment across a challenging year, according to research conducted by FinTech Global.

This was headlined by a sharp 44% reduction in deal numbers compared to the previous year, with only 126 deals sealed across Europe.

Concurrently, the total investment in European InsurTech companies plummeted by a shocking 84%, amounting to $823m, showcasing a significant departure from the previous funding levels in 2022.

This concerning decline is attributable to numerous factors. Firstly, certain segments of the insurance industry, such as personal property and casualty (P&C) and health insurance, reached a phase of relative maturity, according to a BCG report. Consequently, these sectors had lower expectations for private investment growth, and therefore had a more disappointing view by this metric.

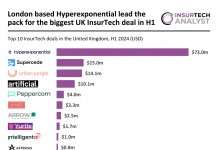

Despite the negatives, the UK emerged as a clear frontrunner in the realm. The nation bagged an impressive 46 deals throughout the calendar year. This accounted for a staggering 37% share of the overall total from across the continent.

At the zenith of this were six of Europe’s top ten deals, which all went the way of the UK, and was headlined by a monstrous $129m deal secured by London-based software specialists Quantexa. The firm raised the funds in their latest Series E funding round, led by GIC.

The move was a continuation of the organisation’s impressive growth, having seen their ARR over 100% since closing their Series D round. The company’s successful performance spans various regions, including a significant surge in North America, where ARR soared by over 180%.

The deal also secured the British tech firm the highly-coveted unicorn status as their value soared to $1.8bn following the completion of the round.

Despite the monopolisation at the top of the leaderboard, other nations from around Europe did feature towards the sharp-end. Most prominently, France was the second most active nation with 16 deals, and a 13% share, while Germany was third with 15 deals, and a 12% share.

The rest of the top ten deals were taken up by a handful of other rounds. Germany’s wefox secured the most impressive tranche, bagging $55m, while other large deals were secured by Sweden’s Hedvig ($38m) and Lassie ($25m), as well as France’s AKUR8 ($25m).

Looking ahead toward 2024 and beyond, the UK’s Financial Conduct Authority (FCA) is looking to play a more pivotal role in the nation’s success in the sector. It is hoping it will achieve this by finalising rules for insurance firms concerning the transfer and replacement of retained EU law provisions from the Insurance Distribution Directive (IDD). These regulatory adjustments, effective from April 5, 2024, encompass all firms involved in insurance activities. They aim to ensure a seamless transition post the UK’s exit from the EU, replacing IDD delegated regulations with the FCA’s own rules and guidance while upholding essential requirements.

Keep up with all the latest FinTech news here

Copyright © 2024 FinTech Global