UK InsurTech companies saw their funding double in 2023 compared to the previous year, defying global trends from across the sector.

In total, UK firms raised a combined $395m in 2023, a 43% increase from 2022, according to research from InsurTech Analyst.

This total was raised over 40 deals – which were primarily larger raises – as total deal activity decreased 35% year-on-year. In fact, the average deal size in the UK InsurTech sector increasing to $9.9m, more than doubling from the figures recorded in 2022.

The largest of these tranches was secured by Quantexa, a firm which provides data analytics for anti-money laundering. The London-based firm secured a whopping $129m in a deal which marked the largest European InsurTech deal in 2023, in a round led by GIC.

These large deals are a far cry from the global trends across the sector – underlining the UK’s success in the InsurTech space.

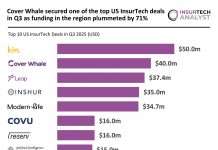

According to FinTech Global, the total investment in European InsurTech companies plummeted by a shocking 84% in 2023, amounting to $823m, showcasing a significant departure from the previous funding levels in 2022.

This was headlined by a sharp 44% reduction in deal numbers compared to the previous year, with only 126 deals sealed across Europe. Impressively, the UK’s aforementioned 46 deals account for a staggering 37% share of the overall total from across the continent.

This concerning decline is attributable to numerous factors. Some parts of the insurance industry, like personal property and casualty (P&C) and health insurance, have entered a mature phase, according to a BCG report. This is leading to lower expectations for private investment growth.

To read the latest breaking InsurTech stories as they happen visit www.insurtechanalyst.com

Copyright © 2024 InsurTech Analyst