Slide Insurance, an InsurTech company specialising in homeowners insurance, has secured a $175m senior credit facility.

The facility was led by Regions Bank, which acted as the administrative agent, joint lead arranger, and joint bookrunner. Synovus Bank and Texas Capital Bank, through its TCBI Securities Inc. division, also participated as joint lead arrangers and joint bookrunners, according to InsurTech Insights.

Slide Insurance, known for its innovative approach to homeowners insurance, plans to use the newly acquired funds to refinance a previous bilateral senior credit facility from Regions Bank and to support various organic and inorganic growth initiatives.

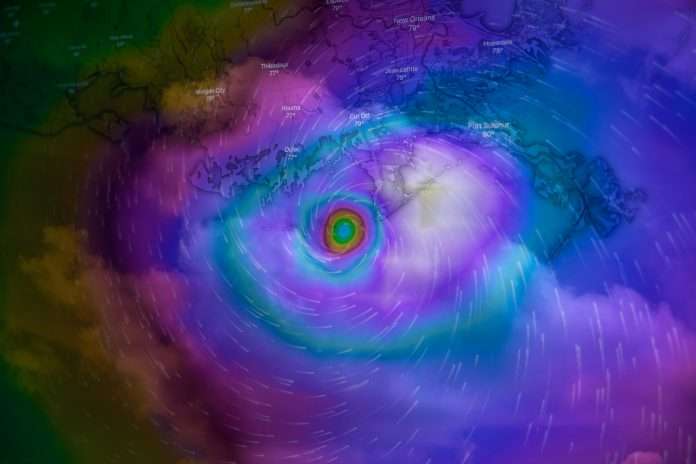

This financial boost comes as the company prepares for the 2024 Atlantic hurricane season and the second half of the year.

The InsurTech firm, which made headlines last year by securing renewal rights for 86,000 homeowners in Florida, aims to strengthen its market position and financial stability with this new investment.

Slide Insurance raised $100m during its Series A round in 2021, further establishing its presence in the industry.

In recent months, Slide has strategically enhanced its financial resilience. In May, the company completed a $1.86bn reinsurance programme for the 2024 hurricane season, meeting all regulatory and rating agency requirements and providing protection up to the 175-year return period.

Additionally, in April, Slide finalised pricing for a $210m Purple Re Ltd. (Series 2024-1) catastrophe bond, which bolsters its storm and hurricane reinsurance coverage in Florida and South Carolina.

Bruce Lucas, Founder and CEO of Slide Insurance. said: “This is a significant milestone for Slide and further demonstrates our strong financial strength and solvency. We are continuing to grow the company while offering affordable, and much needed, solutions to our policyholders. This one of the largest loans ever made to a Florida insurer and will provide additional reserve capital to continue our growth trajectory.”

Copyright © 2024 InsurTech Analyst