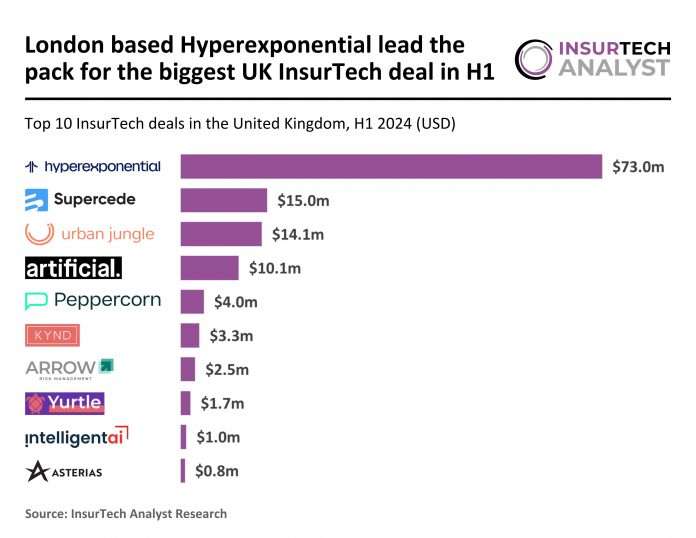

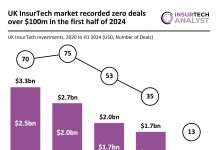

Key UK InsurTech investment stats in H1 2024:

- UK InsurTech deal activity dropped by 32% in H1 2024 YoY

- The average deal size completed by UK InsurTech companies dropped to $10.9m as investors shifted to a conservative approach

- hyperexponential, a leader in pricing decision intelligence (PDI) software, secured the biggest InsurTech deal in the UK for the first half of the year with Series B funding round of $73m

In H1 2024, the UK InsurTech sector experienced a notable decline in both deal activity and total funding. Only 13 deals were recorded in the first half of the year, reflecting a 32% drop compared to the 19 deals completed in H1 2023, and an 18% decrease from the 16 transactions in H2 2023. Funding saw a much sharper fall, with UK InsurTech companies raising just $142m in H1 2024, a staggering 85% decrease from the $959m raised in H1 2023, and an 82% drop from the $778m raised in H2 2023. This significant reduction in funding suggests that the UK InsurTech sector is experiencing tightening financial conditions, potentially due to broader macroeconomic challenges and a more cautious investment landscape.

The average deal value in H1 2024 stood at $10.9m, a drastic decline from the $50.5m average in H1 2023. This considerable decrease in average deal size indicates that investors are now focusing on smaller deals, likely reflecting heightened risk aversion and a shift towards more conservative investments. If this trend continues, deal activity in the UK InsurTech space could remain subdued throughout the rest of the year, with overall funding levels significantly below those of previous years.

hyperexponential, a global leader in pricing decision intelligence (PDI) software, concluded the biggest funding round of the first half of the year in the UK InsurTech space with a $73m Series B funding round, backed by major US venture capitalists. hyperexponential’s PDI platform, hx Renew, enabled insurers to leverage large and alternative datasets, develop and refine rating tools rapidly, and employ sophisticated machine learning approaches to price risk and make data-driven pricing decisions at the portfolio and individual level. Since the company’s Series A in 2021, hyperexponential grew sales 10x while staying profitable, serving some of the world’s largest insurers, including Aviva, HDI, and Conduit Re. This latest round of financing would support hyperexponential’s expansion into the United States, targeting the opening of its New York office this year, and enabling increased investment in new product capabilities to serve growing client demand in adjacent insurance markets, including the SME insurance sector. The company planned to double its global team to over 200 in the next year.

Keep up with all the latest InsurTech news here

Copyright © 2024 InsurTech Analyst