Key European InsurTech investment stats in Q3 2024:

- European InsurTech deal activity increased by a third QoQ

- Investors prioritise deals under $100m with an 82% increase compared to Q2

- Akur8, a machine learning-powered platform for insurance pricing and reserving, secured a $120m Series C funding round making it one of the biggest European InsurTech deals for the quarter

In the third quarter of 2024, the European InsurTech sector saw a mixed performance in deal activity and funding compared to previous quarters.

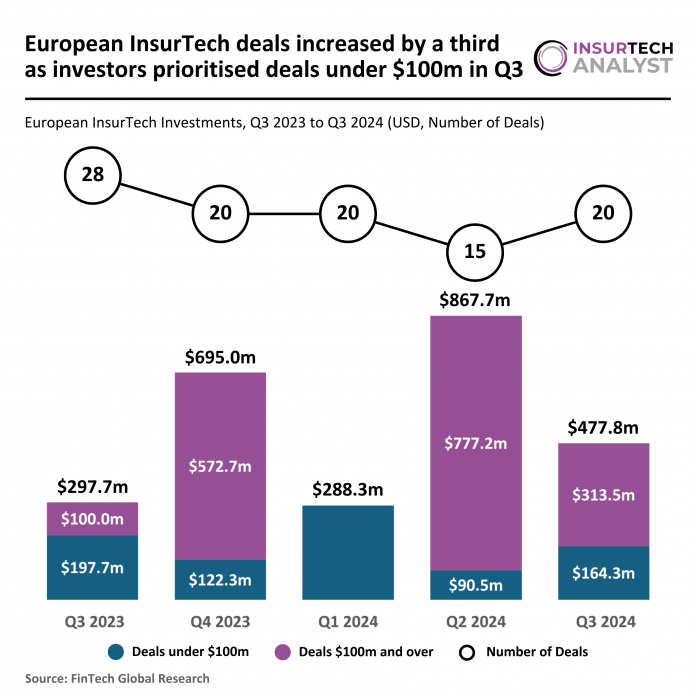

Q3 2024 closed with 20 deals, a 29% decrease from the 28 deals recorded in Q3 2023. However, it represented a 33% increase over the 15 funding rounds seen in Q2 2024, signalling a potential rebound in deal volume.

Total funding in Q3 2024 reached $477.8m, which was a 60% increase from the $297.7m raised in Q3 2023, though it reflected a notable 45% decline from the $867.7m raised in Q2 2024, signalling that while the InsurTech investment market remains down it potentially has bottomed out.

If current trends persist, the projected deal count for 2024 would be 80 deals, marking a 26% drop from the 108 transactions completed in 2023.

Projected funding for 2024 is $1.8bn, representing a 19% decline from the $2.2bn raised in 2023.

These figures underscore a challenging landscape for the European InsurTech sector, where deal volume is shrinking and funding levels are fluctuating, likely in response to broader economic uncertainties and more selective investment strategies within the market.

Funding from deals under $100m totalled $164.3m in Q3 2024, representing a 17% decrease from the $197.7m recorded in Q3 2023 but an 82% increase over the $90.5m raised in Q2 2024, indicating a resurgence in smaller deals.

Larger deals valued at $100m or more accounted for $313.5m in Q3 2024, a significant increase from the $100m raised by such deals in Q3 2023, though down 60% from the $777.2m seen in Q2 2024.

This downward trend in high-value transactions reflects investors’ caution as they navigate a volatile market, opting for a balanced approach with fewer large-scale investments and a strategic focus on smaller deals.

Akur8, a machine learning-powered platform for insurance pricing and reserving, has achieved one of Europe’s biggest InsurTech deals of the quarter by securing $120m in Series C funding, bringing its total investment to $180m.

The round was led by growth equity firm One Peak, with contributions from Partners Group and existing investor Guidewire Software, Inc.

This latest funding will drive Akur8’s ambitious growth strategy, supporting product innovation with new modules—Optim, for optimizing pricing strategies, and Deploy, a rating engine to streamline rate deployment.

Following its recent acquisition of the Arius reserving platform, Akur8 is set to expand its capabilities in the reserving sector, targeting new markets and bridging the gap between pricing and reserving.

With these developments, Akur8 is well-positioned for rapid global expansion, especially in North America, as it tailors its AI-driven SaaS solutions to meet market demands and broaden its impact across non-life insurance segments.

Keep up with all the latest InsurTech news here

Copyright © 2024 InsurTech Analyst