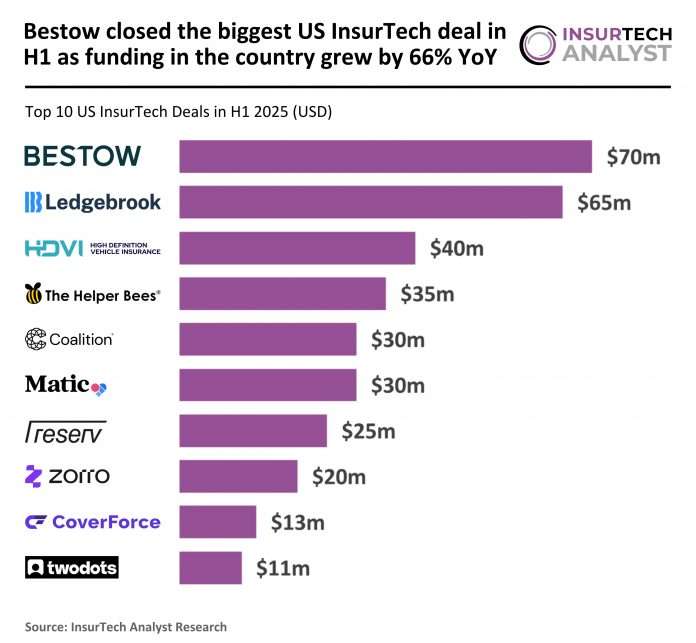

Key US InsurTech investment stats in H1 2025:

- US InsurTech funding increased by 66% YoY in H1 2025

- New York companies cemented their spot as the leader in the US InsurTech market completing 30% of the top 10 deals in the first half

- Bestow Inc., a leading InsurTech company transforming the life and annuities sector through its enterprise-focused technology platform, secured the biggest US InsurTech deal of the first half of the year with a $70m Series D equity round

US InsurTech funding increased by two-thirds YoY in H1 2025

In H1 2025, the US InsurTech sector recorded 55 transactions, showing a slight increase of 4% compared with the 53 deals completed in H1 2024.

Funding activity, however, experienced a much stronger rebound, rising to $873.4m in H1 2025, up 66% from the $527.3m raised in the same period of 2024.

This divergence between modest deal growth and a sharp increase in capital raised highlights a shift towards larger deal sizes, suggesting that while investor caution remains, confidence in select high-potential InsurTechs is returning.

The sector’s recovery in funding volume reflects growing optimism that the most resilient players can withstand ongoing market headwinds.

New York companies cemented their spot as the leader in the US InsurTech market completing 30% of the top 10 deals in the first half

The top 10 deals in H1 2025 were led by New York-based companies, which secured three of the largest transactions, though this was slightly down from four in H1 2024.

California maintained its presence with two top deals across both periods, while Illinois also featured consistently, with two deals in 2024 and one in 2025.

Texas and Massachusetts emerged as new entrants in H1 2025, strengthening their presence in the InsurTech investment landscape, whereas Maryland dropped out of the list.

Ohio remained steady with one top deal in each period.

These shifts underline the continued dominance of New York and California, while also signalling growing investment traction in emerging hubs such as Texas and Massachusetts.

Bestow Inc., a leading InsurTech company transforming the life and annuities sector through its enterprise-focused technology platform, secured the biggest US InsurTech deal of the first half of the year with a $70m Series D equity round

The round, co-led by Growth Equity at Goldman Sachs Alternatives and Smith Point Capital, will fuel Bestow’s continued expansion and accelerate the development of new products tailored to the needs of life insurance and annuity providers.

Having recently shifted focus exclusively to B2B after divesting its consumer-facing life insurance business, Bestow is now positioned as a mission-critical partner for major insurers, offering an end-to-end platform that spans product design, underwriting, and policy administration.

With a 3.5x YoY increase in transaction volume and partnerships with institutions like Nationwide, Transamerica, and USAA, the company is redefining operational efficiency and digital transformation across the insurance value chain.

Keep up with all the latest InsurTech news here

Copyright © 2025 InsurTech Analyst