Federato, a pioneering InsurTech company redefining underwriting intelligence, has unveiled an enterprise-grade agentic AI platform designed to revolutionise how insurers assess, quote, and manage risk.

This comes as insurers face a deluge of submissions and lack the tools to prioritise the best opportunities effectively, as less than 25% of bound risk currently aligns with an insurer’s strategy.

Federato’s new solution aims to eliminate these inefficiencies, enabling underwriters to act on high-value risks in real time rather than relying on outdated manual processes.

By leveraging advanced machine intelligence, the solution can generate comprehensive quotes within minutes — a process that traditionally takes hours or even days.

It uses the same logical framework as human underwriters but executes decisions at machine speed. Each quote also includes a detailed explanation of the AI’s reasoning, ensuring transparency and trust in automated decision-making.

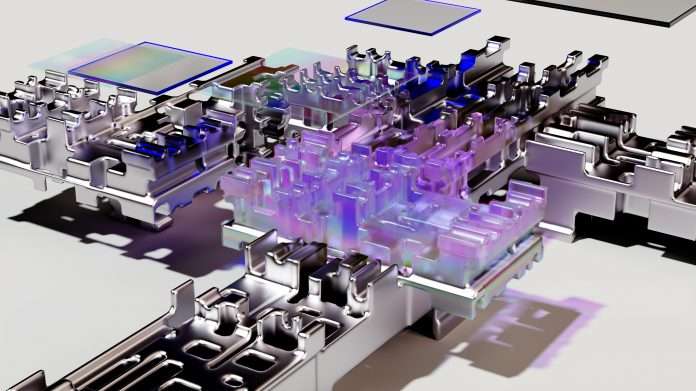

Alongside its AI launch, Federato introduced Control Tower, an upgraded platform offering real-time portfolio management for insurers. Developed in collaboration with dozens of P&C insurers, Control Tower provides governance, visibility, and strategy alignment across underwriting operations. It converts static documentation and outdated guidance into proactive, AI-powered guardrails that guide every risk decision.

The launch of both agentic AI and Control Tower represents Federato’s broader mission to help insurers escape legacy technology constraints.

By combining automation, real-time analytics, and portfolio oversight, the company enables insurance providers to embrace a future-ready, AI-native infrastructure that supports full policy lifecycle management.

Federato co-founder and CTO William Steenbergen said, “It’s a transformative way of working. AI analyzes large amounts of data at machine speed, while freeing expert underwriters to do what they do best: making nuanced decisions and building relationships.”

Federato CEO and co-founder Will Ross said, “For decades, the insurance industry has been held back by an Old Core of technologies, built on compromised legacy systems and siloed data. What was once a solution is now a problem as these systems can’t meet the needs of the rapidly evolving industry. For the first time, insurers can choose an AI-native platform that spans the full policy lifecycle – one that’s future-ready and able to help our customers drive better business outcomes every day.”

Keep up with all the latest FinTech news here

Copyright © 2025 FinTech Global