Tag: Health Insurance

Engage People and Medibank boost health rewards

Engage People has extended its strategic partnership with Medibank, one of Australia’s largest health insurers, to enhance its digital loyalty and rewards offering.

GoHealth gains $115m to fuel strategic growth

GoHealth has announced a set of strategic capital and governance moves aimed at strengthening its financial flexibility and positioning for long-term growth, alongside releasing its second quarter 2025 financial results.

Over half of insurance execs view tech firms as strategic partners

Global Insurance Trends 2025:

43 senior insurance executives across more than 10 countries were surveyed for NTT DATA’s InsurTech Global Outlook 2025

Over half...

Zorro secures $20m to transform AI-powered health benefits

Zorro, a next-generation benefits administration platform, has secured $20m in Series A funding as it looks to transform how healthcare benefits are delivered to brokers, employers and employees across the United States.

74% of insurers are prioritising digital transformation and tech adoption in...

74% of insurers are prioritising digital transformation and tech adoption in 2025

43 leading insurance C-level executives from across more than 10 countries...

Sapiens launches UnderwritingPro v14 with AI-powered automation for life insurers

Sapiens International Corporation has introduced the latest version of its automated underwriting and new business case management platform, designed specifically for life and annuities insurers.

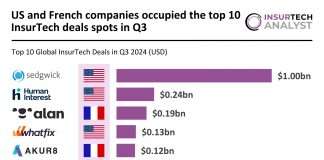

US and French companies occupied the top 10 InsurTech deals spots...

Key Global InsurTech investment stats in Q3 2024:

Global InsurTech deal activity dropped by 49% YoY

US and French companies completed all of the...

How to retain life and health insurance customers

Customer retention is a critical focus for life and health insurers, who must now navigate an evolving market landscape characterised by increasing customer expectations. Providing personalised experiences, streamlining claims processes, and implementing wellness programmes are all essential strategies that insurers can leverage to enhance customer engagement, reduce churn, and foster long-term loyalty. Digital health engagement platform dacadoo offers up some ideas as to how life and health insurers can retain their customers.

The changing face of health insurance

Health insurance plays a critical role in safeguarding individuals and families from the financial burdens of medical expenses, offering essential coverage and peace of mind during times of illness or injury. Traditionally, the industry relied on complex and rigid models, often burdened by lengthy paperwork, slow claims processing, and fragmented communication. However, the health insurance market is projected to reach a remarkable $2.38tn in gross written premiums by 2024, according to Statista. This comes amidst a significant shift towards digital platforms and telemedicine services.

Trupanion launches signature medical insurance product in Germany and Switzerland

Trupanion, Inc., a leading global provider of medical insurance for cats and dogs, has announced the official launch of its high-quality pet insurance product in Germany and Switzerland.