Tag: technology in insurance

FullCircl backs BIBA 2025 Manifesto, calls for regulatory and tech advancements

BIBA has unveiled its 2025 Manifesto, "Partnering to Deliver More Value," at the Houses of Parliament, reinforcing the critical role insurance plays in the UK economy.

Root Inc refinances $200m term loan facility with BlackRock to boost...

Root, the Columbus, Ohio-based parent company of Root Insurance Company, has announced a successful refinancing of its term loan facility.

The capital was supplied by...

INSHUR secures $19m led by Viola Growth to bolster US and...

INSHUR, the multi-award-winning embedded insurance provider for the on-demand economy, has recently closed a funding round securing $19m.

Ledgebrook’s innovative push in InsurTech garners $17m Series B funding

Ledgebrook, the rapidly growing InsurTech firm, has successfully closed a $17m Series B funding round.

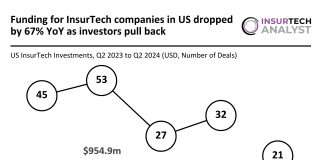

Funding for InsurTech companies in US dropped by 67% YoY as...

Key US InsurTech investment stats in Q2 2024:

US InsurTech funding dropped by 67% YoY during the second quarter

The average deal size completed...

Mastering the underwriting process: How to avoid common pitfalls

In the high-pressure world of insurance underwriting, falling into autopilot is an easy yet dangerous trap. This risk is heightened when underwriters face a continuous stream of similar accounts, leading to quick decision-making that might overlook critical details.

AXA and AWS partner to revolutionise B2B risk management with new...

AXA, a global insurance and asset management behemoth, and Amazon Web Services are setting the stage for a groundbreaking collaboration with the development of the AXA Digital Commercial Platform (DCP).

Revolutionising insurance: The top 6 benefits of automating underwriting

The evolution from manual to automated systems in the insurance industry marks a significant leap towards efficiency and precision. This transition, driven by the need to overcome the limitations of traditional underwriting methods, has paved the way for a new era of insurance operations. An automated underwriting system stands at the forefront of this transformation, leveraging advanced analytics and algorithms to streamline decision-making and risk assessment processes.

Revolutionising insurance pricing: To build or partner for success

The landscape of the insurance industry is undergoing a profound transformation, driven by rapid technological advancements.

PoloWorks and PwC UK forge strategic InsurTech alliance to revolutionise insurance...

PoloWorks, a pivotal entity within the Marco Capital Group, has joined forces with PwC UK to announce the initiation of PoloPartners.

The inception of PoloPartners...