Tag: Underwriting

The strategic advantage of unified loss control and policy admin systems

In the competitive world of insurance, the profitability of underwriting is closely linked to informed decision-making that efficiently mitigates risks and optimizes loss ratios. Traditional barriers, primarily the compartmentalisation of data, often hinder this objective.

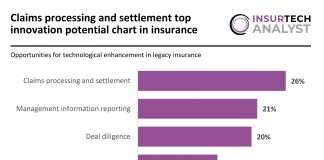

Claims processing and settlement top innovation potential chart in insurance

Key trends in legacy insurance market:

Solvency II, Brexit, and Lloyd’s Decile 10 review were key players in the rapid transformation of the insurance...

The impact of loss run data on insurance operations and negotiations

In the realm of InsurTech, the ability to accurately assess risk, calculate premiums, and determine policy renewals hinges significantly on understanding historical losses.

Oper unveils innovative AI solutions to streamline mortgage underwriting

Oper, a leading innovator in mortgage software, has announced the launch of a set of AI-powered product features designed to transform the underwriting and fulfilment processes in digital mortgage journeys.

Mastering the underwriting process: How to avoid common pitfalls

In the high-pressure world of insurance underwriting, falling into autopilot is an easy yet dangerous trap. This risk is heightened when underwriters face a continuous stream of similar accounts, leading to quick decision-making that might overlook critical details.

Loss control: Underwriting’s secret weapon

In the competitive landscape of insurance underwriting, the integration of risk data is emerging as a secret weapon to enhance the performance of your underwriting team. One way this can be exploited is through the use of loss control, a risk management method aimed at decreasing the likelihood of losses occurring and minimising the impact of any that do happen. Due to the clear benefits of this, numerous key industry players are now claiming that advanced loss control practices can transform the traditional underwriting processes, reducing claims while increasing renewals and premiums.

Is automated underwriting InsurTech’s silver bullet?

Often seen as an industry lambasted for a lack of change, the insurance sector has opened its eyes to a swathe of potential innovative technologies that could revolutionise the sector throughout 2024. At the height of this movement, the principle of automated underwriting emerged as the industry’s great fascination, with its potential to truly become the sector’s silver bullet.

Cytora and Autoaddress partner to revolutionise underwriting with advanced address capture

Cytora, a leader in transforming underwriting workflows within the insurance industry, has announced the integration of Autoaddress‘ Address Capture into its underwriting productivity tool.

Bowhead Specialty partners with Kalepa to enhance underwriting with AI

Bowhead Specialty, a provider of casualty and professional liability products, has announced its deployment of Kalepa’s Copilot underwriting platform to utilise its advanced AI for improved risk selection and optimal customer experience.

INSTANDA and UnderwriteMe partner to revolutionise life insurance with no-code tech

INSTANDA, a leading global provider of SaaS platform technology for life insurance distribution and policy administration, has announced an integration with UnderwriteMe, a comprehensive...