In 2019, the global InsurTech market was valued at $5.48bn. Now, new research has suggested that figure could jump to $10.14bn by 2025, representing a compound annual growth rate of 10.8%.

The ResearchAndMarkets report suggested that the growth can be attributed to the fact that the insurance industry, which had global premiums exceededing $4.9tn in 2017, has begun to modernise.

“Although late, the industry now appears to be at a key inflection point with many experts viewing the digitisation of insurance as the next big opportunity after FinTech,” the researchers said in a statement.

The report suggested that the growth will be noticeable with InsurTech innovators simplifying the claims process, improving communication with clients, and the capabilities to implement automation.

It added that the health insurance market is expected to have the highest growth rate in the upcoming years as the adoption of InsurTech is significantly higher compared to that of other insurance sectors, such as property and casualty, vehicle and others.

Looking at the leading trends of the industry, ResearchAndMarkets noted that the insurance industry has been very slow to innovate and to capitalise on the opportunities of digitalising their offering. The reason for that is that incumbents have been limited by regulation and limited competition.

So, traditional industry players have now begun to sign partnerships with InsurTech startups to help them innovate.

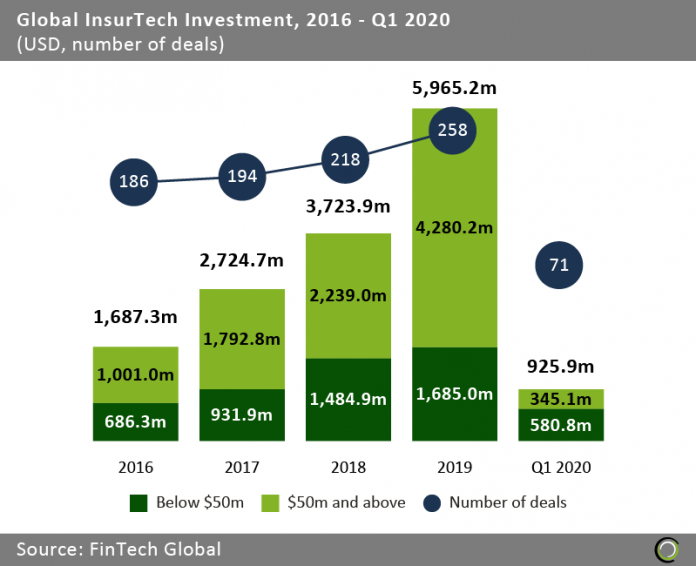

The news comes after FinTech Global’s own research revealed that the InsurTech industry has grown year on year since 2016. That year, the sector attracted $1.68bn in investment. That figure jumped to $5.96bn in 2019.

Some have even suggested that COVID-19 will be the push insurers need to embrace InsurTech innovation. The argument is that the current crisis will demonstrate the need for traditional players to innovate.

Some have even suggested that COVID-19 will be the push insurers need to embrace InsurTech innovation. The argument is that the current crisis will demonstrate the need for traditional players to innovate.

But that doesn’t mean the industry does not have challenges. When FinTech Global recently spoke with Sabine VanderLinden, managing director of Startupbootcamp InsurTech, the accelerator, she said, “I think one of the big challenges InsurTech startups face, like any startup, is actually to make enough money before [they] die. What you find is, there’s still a lot of new startups coming to the market. InsurTech represent approximately 6.5% of [the] overall FinTech startups out there. So there is around 57,000 startups out there, and InsurTechs are probably 3,500 [of those and] of those only 1,500 are invested startups.”

Copyright © 2020 FinTech Global