Despite the troubled global situation, the InsurTech sector managed to continue its yearly growth and hit a new record for annual investment volume.

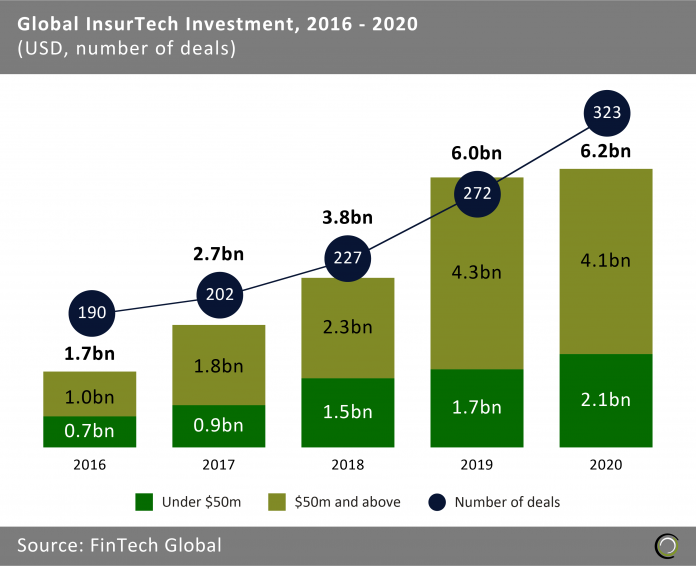

The InsurTech sector has gone from strength to strength. The success of many industries was left ambiguous last year when the pandemic struck. While a lot of sectors and businesses have been heavily damaged by the events of the Covid-19 pandemic, InsurTech is not one of them. Doubts were put on the space, but that was misplaced. The total investment volume reached new heights in 2020, rising from $6bn across 272 deals in 2019 to $6.2bn through 323 transactions last year. This continued to demonstrate the sector’s popularity over the years, with the total capital invested having grown at a compound annual growth rate of 38.4% since 2016.

“The InsurTech sector is now in the phase the Hospitality sector was in 2006-8 when companies like Airbnb, Booking and Homeaway surged and travel operators such as kayak and skyscanner joined,” Air Doctor CEO Jenny Cohen Derfler said. “In 5 to 6 years’ time, the InsurTech sector will be after a complete transformation in how they create, sell and manage their products and their customer experience.”

With there being 51 more transactions in 2020 than 2019, it does suggest that the market is still ripe for startups. If the size of deals had continued to rise but the total number of deals declined, it could suggest the market was consolidating and companies would be closing bigger funding rounds. However, with the capital and deal volume increasing, it suggests the sector is still ripe for innovation and new companies to form.

“In the last couple of years a lot of financial resources are being redirected to InsurTech startups, nonetheless the technology achievements reached thus far are scarce, and they feel more like a drop of water in the ocean,” Derfler added. This point was echoed by many others. There is room for a lot more development in InsurTech.

KYND CMO and co-founder Melanie Hayes said, “Although FinTech is probably in the forefront of people’s minds, InsurTech is at a key inflection point and digitisation of insurance is a growing opportunity for a number of reasons.”

The first reason offered by Hayes is that every organisation now relies on technology and it is revolutionising how industries work. However, they do not have innovation in their DNA. For example, in cyber insurance, pricing is reliant on historical and time consuming assessments that are not capable of coping with the masses of claims coming in 2020. Hayes said, “It’s hard for insurers, particularly the large carriers, to innovate and meet the challenges of increasing digital technology, when they have so much to contend with already namely regulation and being bound by inherent legacy systems and processes.”

Secondly, Hayes believes InsurTech is primed to capitalise on the problems within insurance. The market is plagued with complexities, regulations and poor in-house digitalisation. “This means it’s a great opportunity for new InsurTech companies and investment in them is likely to continue in not only global InsurTechs but also UK InsurTechs.”

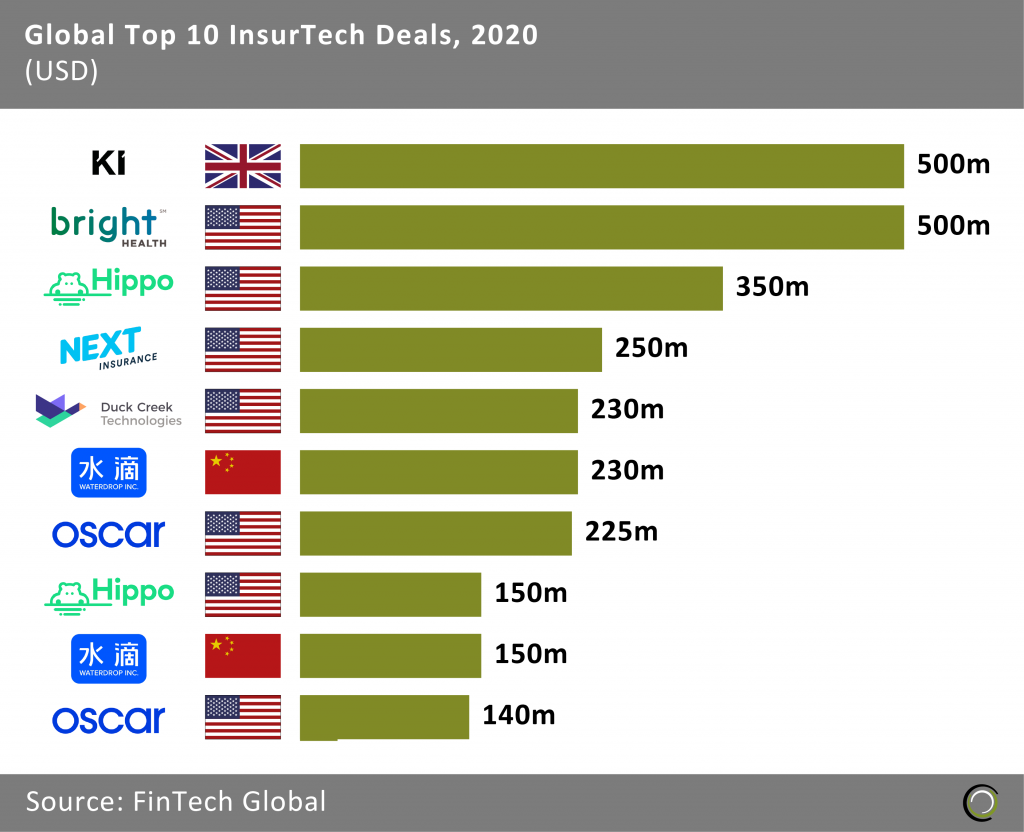

Further testament to the success of InsurTech over the past year is the growing list of unicorns. Small business insurance provider Next Insurance increased its valuation to $2bn after a $250m Series D. Hippo was one of the InsurTechs to reach the coveted status, after the homeowner insurance company raised a $150m investment which put its company valuation at $1.5bn. India-based digital insurance platform Digit Insurance hit a $1.9bn valuation in January, showing the sector is continuing its growth in 2021.

It is not just the presence of unicorns that express how the sector is generating a lot of excitement. The top ten InsurTech deals raised in 2019 raised a combined $2.7bn, showing the sector has a mix of early and late-stage companies.

While the market is clearly not ready for consolidation, would the market be better off if it did start to do so? “It really depends,” Life.io CEO and co-founder Jon Cooper said. “From my perspective, consolidation amongst carriers is typically more of a defensive play protecting against disruption and the low interest rate environment and essentially preserving the status quo. On the other hand, consolidation amongst InsurTechs is more of an offensive play in favour of progress which benefits consumers and the industry at large.”

Consolidation is not on the cards just yet, but there are a handful of big InsurTechs helping to shine a beacon on the sector’s potential. The recent success of Lemonade’s initial public offering could bring more appetite to the InsurTech scene. During the first day of trading, Lemonade’s shares skyrocketed from $29 apiece to $50. At close on that initial day, the InsurTech had reached a $3bn market cap.

“The lemonade IPO has validated that InsurTechs are an important part of the FinTech ecosystem,” Cooper said. “It also has helped quiet the sceptics who believed direct to consumer (D2C) insurance wouldn’t work. The scary thing is that many of the c-suites still believe they are immune to their digital disruptors. Make no mistake, Lemonade and other digital disruptors will only get a stronger hold on the market. Incumbents who are not massively investing now to embrace digital and D2C distribution are in for a rude awakening.”

Lemonade is just the beginning and there will likely be a long list of InsurTechs that will follow suit with IPOs. Earlier in the month, Oscar Health filed for an IPO with the New York Stock Exchange. Another company eyeing its public launch is Policybazaar, which is reportedly expected to happen at some point this year and could value the business at $3.5bn. The InsurTech sector looks set to continue to grow.

How the pandemic impacted InsurTech

As mentioned, when countries began to lockdown and the extent of the pandemic was fully realised, question marks were placed over the InsurTech sector and how it would cope. Insurance firms have notoriously been slow to adopt technology, but Covid-19 forced them to accelerate their digitalisation initiatives. They had to ensure their staff could continue doing their jobs from home, but also provide support for consumers in a new remote world.

While it looks like prime pickings for a flexible tech startup that could integrate with a firm and help with their digitalisation efforts, it is not that simple. InsurTech startups will not always have a lot of cash, meaning the tough market to sell into could be very damaging. There were also fears that companies could potentially weather the storm and wait it out. Furthermore, segments like travel insurance were in trouble as holidays were being cancelled. Air Doctor director of marketing and global partnerships Yuval Zimerman previously said that the lockdown placed travel insurance companies on red alert as less people would be travelling. Against expectations, the industry just adapted to the new normal. Zimerman explained that people were still eager to travel and companies just needed to address their new concerns and support them in a new way.

Hayes stated that before the pandemic a lot of insurers simply looked at InsurTech as a way to do what they always have done, only faster and cheaper, rather than revolutionising operating and business models. “The initial thinking at the outbreak of the pandemic was that investment in these companies would naturally decline as other priorities took precedence,” she said. However, as the data previously mentioned showed, funding into InsurTech has continued to rise during the pandemic.

“In fact, the pandemic in some instances seemed to prompt many insurers to accentuate their digital transformation efforts and seek InsurTechs that can help accelerate virtual interactions in sales and claims, as well as reduce expenses,” she added. One example of such an instance is Beazley, the parent company of specialist insurance businesses. The company’s chair David Roberts stated the past year was a catalyst to improve how it operates.

Why did the pandemic do so well for the sector? “The sector did better than expected for lots of different reasons – depending on your lines of business,” Garth said. “On the personal lines front for auto there were fewer claims due to significantly less driving. With so many insurers stopping travel by employees or consultants working on projects — this decreased costs or helped accelerate additional projects that made a difference in the business. In addition, the pandemic has heighted an appreciation and value for insurance – whether for P&C coverage or L&A coverage — driving new sales and opportunities.”

Copyright © 2021 FinTech Global