Key trends in legacy insurance market:

- Solvency II, Brexit, and Lloyd’s Decile 10 review were key players in the rapid transformation of the insurance run-off sector.

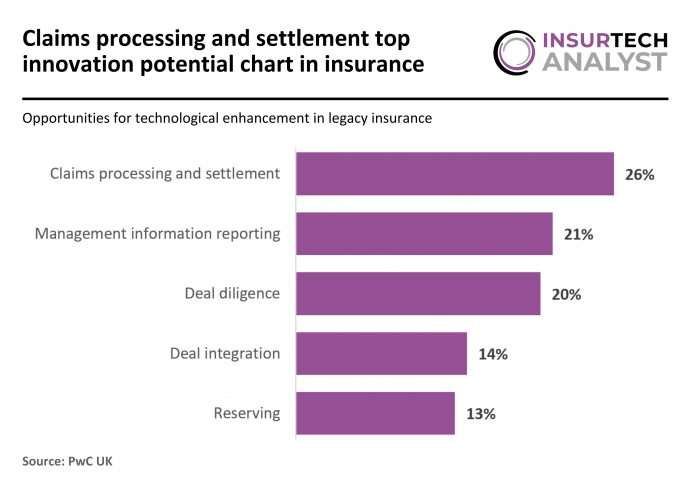

- A PwC survey identified that the legacy insurance sector has been slow to adopt to newer technologies like AI and cloud computing.

- However, in the recent past the sector has been catching up and majority of survey respondents felt that claims processing and settlement was a key area to start

In early 2024, PwC UK released the fifteenth edition of its Global Insurance Run-Off Survey, offering a deep dive into the evolution of the legacy market within the insurance industry. The survey, reflecting the insights of UK insurance and Lloyd’s of London market leaders, tracks the significant changes that have reshaped the sector over the past decade. Originally, the concept of run-off was associated with financial distress, particularly linked to the surge of asbestos claims that once threatened key markets. However, throughout the survey’s history, the run-off sector has rapidly transformed into a vital component of the insurance lifecycle. Catalysts such as Solvency II, Brexit, and Lloyd’s Decile 10 review, alongside private equity investments and active broker participation, have driven this shift.

The survey highlights how top-tier insurance clients now engage with the legacy market to optimise capital and operations, achieving strategic objectives. Some of the key findings from the survey were on the use and maturity of technology within the legacy sector, the appetite for liabilities in various portfolios, and top value creation levers in managing non-life run off-business.

One of the key takeaways from the survey is the growing recognition of technology’s transformative impact on the legacy insurance market. Historically, the sector lagged behind the live insurance market in technology adoption, relying on outdated systems primarily for basic operations like claims processing and finance management. However, the gap between the legacy and live markets has been steadily closing, particularly over the past few years. The survey reveals that modern technology platforms, including cloud computing and AI, are increasingly being integrated into the legacy sector, particularly in areas such as claims processing and settlement (26%), management information reporting (21%), and deal diligence (20%). These technologies enable more efficient data analysis and faster decision-making, enhancing the overall deal lifecycle. With these advancements, the legacy market is not only catching up but is also poised to play a leading role in the insurance industry. As indicated by the respondents, the application of innovative technology in the legacy sector is set to improve operational efficiency and strategic decision-making, ensuring that insurers can better assess and capitalise on opportunities within the market.