Key Global InsurTech investment stats in H1 2025:

- Global InsurTech deal activity dropped by 19% YoY in H1

- US companies secured half of all deals to reinforce their position as the global InsurTech hub

- High Definition Vehicle Insurance (HDVI), a technology-first commercial auto InsurTech, secured one the largest global InsurTech deals of H1 with a $40m growth capital raise

Global InsurTech deal activity dropped by 19% YoY

In H1 2025, the global InsurTech market recorded 132 deals, representing a 2% increase from the 130 deals in H2 2024 but an 19% drop compared to the 162 deals completed in H1 2024.

Funding totalled $1.5bn in H1 2025, down 47% from the $2.8bn raised in H2 2024, yet showing a slight 9% increase from the $1.4bn secured in H1 2024.

Despite the modest rebound in funding compared to the same period last year, the ongoing decline in deal volume reflects a cautious investor stance, with capital more selectively deployed across fewer opportunities.

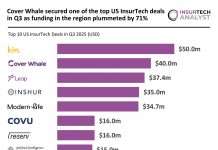

US companies secured half of all deals to reinforce their position as the global InsurTech hub

The US remained the leading InsurTech hub globally, completing 69 deals in H1 2025 (52% share), slightly down from 71 deals (44% share) in H1 2024.

The UK followed with 11 deals (8% share), a decline from 14 deals (9% share) in the same period last year.

Spain emerged as the third most active market with five deals (4% share), replacing Canada, which had recorded nine deals (6% share) in H1 2024.

While overall volumes have dropped, the US expanded its share of global deal activity, suggesting it continues to dominate the global InsurTech landscape even as other markets contract or shift in rank.

High Definition Vehicle Insurance (HDVI), a technology-first commercial auto InsurTech, secured one the largest global InsurTech deals of H1 with a $40m growth capital raise

The round was co-led by existing investors 8VC, Autotech Ventures, Munich Re Ventures, and Weatherford Capital, and will accelerate the expansion of HDVI’s telematics-based product suite, nationwide coverage, and digital tools for agents.

HDVI’s platform leverages over 7.5bn miles of telematics data to transform underwriting and claims processing, enabling dynamic pricing, real-time risk assessment, and tangible safety improvements for fleet operators.

Since launching HDVI Shift™ in 2021, the company has achieved a 107% compound annual growth rate while maintaining a loss ratio well below industry averages.

With enhanced reinsurance capacity from A+ rated global reinsurers and a leadership transition geared for scaling, HDVI is doubling down on its data-driven approach to redefine commercial auto insurance by aligning safety performance with pricing incentives and operational efficiency.

Keep up with all the latest InsurTech news here

Copyright © 2025 InsurTech Analyst