Insurance investment stats in 2025:

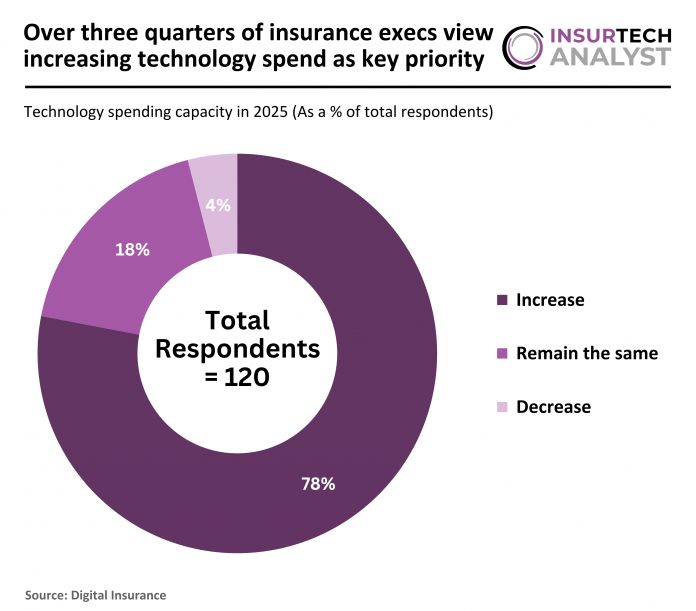

- 120 insurance leaders across carriers, agencies and tech firms were surveyed on 2025 priorities

- 78% of respondents expected to increase technology spending, led by AI, analytics and cloud

- Insurers viewed higher tech spend as a key driver of resilience, customer experience and future growth

120 insurance leaders across carriers, agencies and tech firms were surveyed on 2025 priorities

Digital Insurance’s Predicting the Future for Insurance report draws on insights from 120 leaders and senior professionals across insurance carriers, agencies and technology firms.

The study was designed to understand how industry decision-makers expect the macroeconomic, regulatory and technological landscape to evolve in 2025 and beyond.

With respondents primarily holding director-level and senior management roles, the survey provides a clear view of how insurers are preparing to navigate inflationary pressures, regulatory uncertainty and shifting customer expectations, as well as how they intend to leverage emerging technologies to strengthen competitiveness.

78% of respondents expected to increase technology spending, led by AI, analytics and cloud

A striking 78% of insurance professionals stated that their organisations would increase technology spending in 2025, signalling strong confidence in digital transformation as a growth accelerator.

These increases range from modest rises of 1% – 9% (31%), through to more substantial uplifts of 10% – 19% (33%) and more than 20% (14%). Only a very small minority anticipated any reduction in spend.

The areas attracting the greatest investment – customer service (18%), sales (18%) and claims (18%) – underscore the industry’s push to enhance every stage of the customer journey.

Health insurers, in particular, demonstrated a steep prioritisation of customer service, rising to 42%.

When asked to identify their top digital transformation priority for 2025, respondents ranked artificial intelligence and machine learning first (36%), followed by big data and analytics (28%) and cloud and digital infrastructure (26%), reflecting a clear commitment to adopting advanced, scalable technologies.

Insurers viewed higher tech spend as a key driver of resilience, customer experience and future growth

Although the industry faces potential headwinds – from regulatory uncertainty to climate-linked risks – respondents see enhanced technology investment as a strategic enabler rather than a cost burden.

Higher digital spend is expected to support stronger operational resilience, greater transparency, and faster, more intuitive customer experiences.

As customers increasingly embrace digital channels, insurers anticipate that improved online capabilities, boosted automation and AI-supported decision-making will help them meet rising expectations while maintaining profitability.

Rather than viewing technological disruption as a threat, the survey suggests that insurers are positioning themselves to harness innovation proactively, using expanded tech budgets to strengthen competitiveness and future-proof their business models.

Keep up with all the latest InsurTech news here

Copyright © 2025 InsurTech Analyst