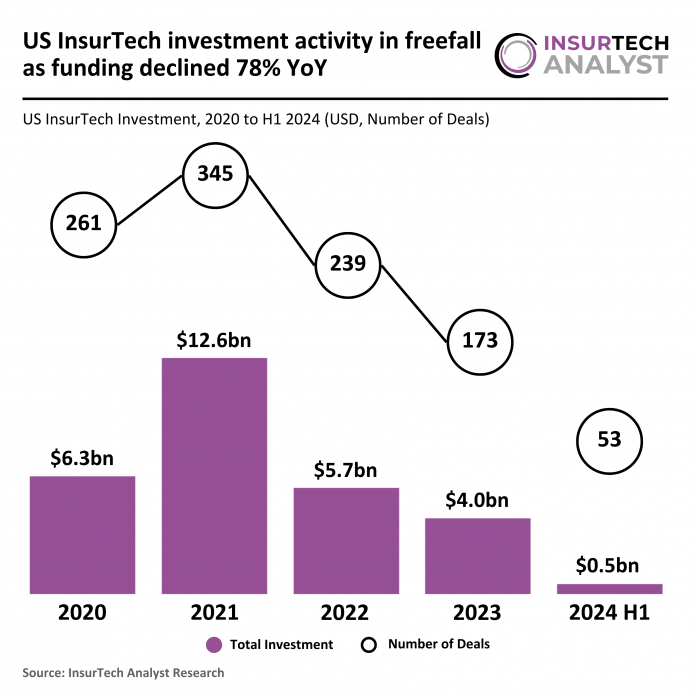

Key US InsurTech investment stats in H1 2024:

- US InsurTech market in a slump as funding dropped by 78% YoY

- Healthee secured the biggest InsurTech deal in the US in H1 2024 with Series A funding round of $32m

- California cemented its place as the top hub for InsurTech and FinTech in the US after topping both lists for deal activity

In H1 2024, the US InsurTech sector saw a notable drop in both deal activity and funding. Only 53 deals were recorded during the first six months of 2024, marking a 43% decrease compared to the 93 completed in H1 last year. Funding also saw a steep decline, with InsurTech companies raising just $0.5bn during the first six months of 2024, a steep decline of 78% from the $2.3bn raised in H1 2023. If deal activity continues at the rate recorded in the first six months of the year, the projected total for 2024 would be 106 deals, a 30% decrease from last year’s total of 153.

Healthee, a healthcare tech and InsurTech pioneer, secured the largest InsurTech deal in the US for the first half of 2024 with a $32m Series A funding round co-led by Fin Capital, Glilot Capital Partners, and Group11, alongside strategic partner TriNet (NYSE: TNET). Focused on enhancing care outcomes and reducing costs for employers and employees, Healthee’s platform offers personalised, instant answers to coverage, treatment, and benefits questions, along with comprehensive open enrolment support and tailored preventive care suggestions. The new funding will drive strategic scaling, accelerate product development, and support expansion initiatives, reinforcing Healthee’s commitment to transforming the healthcare landscape through its innovative, AI-driven solutions. This investment highlights Healthee’s growing influence in the space, as it continues to empower employers to manage health costs effectively while enhancing the overall employee experience.

California has firmly established itself as a leading hub not only for InsurTech but for FinTech as a whole, consistently driving the majority of transactions in the US. In the first half of 2024, California dominated the InsuTech sector with 15 deals, representing 28.3% of the national total. This dominance is mirrored in the broader FinTech landscape, where California-based companies led the nation with 497 funding rounds, capturing 31% of the market despite a significant decline from the previous year. The state’s sustained leadership in both InsurTech and FinTech underscores its crucial role in shaping the financial technology ecosystem across the country.

Copyright © 2024 InsurTech Analyst